Today, as the business world becomes more complicated than the past, many internal accounting managers face with challenging situations. And situation like Kranbraek Corporation makes an internal accounting manager a hard decision between his professional ethics and accepting orders from his or her boss. What really matters is that this is violation of the professional codes of ethics, and it is going to end up with the collapse of the company.

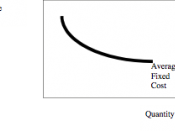

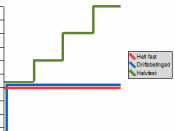

Cellant, who is the president of Kranbraik Corporation, has ordered the companyáïs controller to scrutinize all costs that are currently classified as period cost and reclassify as many as possible as product costs. It is meant to convert fixed costs to variable one so that fixed cost that should be incurred this year can be portioned to next year. It sounds clever to debit selling expenses as cost of goods sold which is going to be charged over the next year when the sales amounts are quite high.

However, the cost of goods sold next year are going to be higher than actual cost of goods sold, then the other aspects of the situation are going to cause the controller to cook the accounting books in other places. Reclassifying period costs to product costs will eventually and consecutively cause more problems later on. Moreover, professional auditors will doubt why Kranbrack Corporation cutbacks period costs, and they will eventually find out that the company deceived stakeholders to look fabulous to potential investors by showing impressive earning per share. Finally, the later story implies an fatal disaster.

Whether actual sales accounts donáït exceed the planned amounts, it is proper to cut back discretionary fixed costs like advertising and travel. However, nobody knows how adversely cutting back advertising expense affect is invisible and tremendous. Thus, the controller should not disregard the importance of advertising, so he or she had a better measure how much cutback in advertising does not influence future sales. In addition, no firms can have a profit without investing in advertising. If there are occasions that could make advertising cheaper, but more powerful, the situation is innovative. Otherwise, Krahnbrack Corporation should not abruptly diminish advertising expense.

A great deal of corporations is searching for potential profits, and there are a lot of opportunities to leap these profits. However, some corrupted companies misuse these chances in unethical ways, and todayáïs stakeholders never forgive culprits who deceived them. At any rate, violation of professional conducts of ethics will lead the company to the worst situation. Therefore, Gallantáïs actions are not only unethical but also wrong. Earning per share is not to show how well a company cooks their book, but to measure how much a company deserves to be invested. So, purposeful misrepresentation of information will get investors angry.

I believe that the situation for the controller of the company is hard, and it is natural to think over what decision he or she has to make. In addition, he or she can possibly in a risk to lose the job and I could understand how much conflict the controller has in his or her mind. However, I prefer quitting to working as a corrupted employee, or I will persuade the president to pursue more creative ways to show how well the company is doing.

In conclusion, companies like Kranbrack Corporation should change their strategies to boost sales. There could be product invention, differentiations, and business reengineering to collect more investors. Even though using unethical way of showing Earning per share can temporarily deceive stakeholder, the truth will eventually come out, and angry investors donáït have any tolerance for deceits.

Therefore, it is strongly recommended that the controller should not violate the codes of professional ethics.