"bubble" and collapse 1

"Bubble" and Collapse of the Real Estate Market

Xin Zhou, Joyce

The University of Indianapolis

"bubble" and collapse 2

Abstract

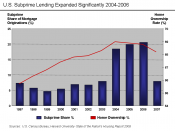

There are several times of "bubble" and collapse of the real estate market happened in the recent and current years. Before 9/11, more than 50 percent of all the mortgages were made to home- buyers who were at or below the median income, and it led to "bubble". After 9/11, GDP growth decreased and the unemployment rate increased, and the housing bubble burst. After 2001, the U.S. government used long-term low interest rates, which led to excess liquidity in the market. Money became nowhere to go into the real estate market, blowing a huge bubble. Current state of the real estate market seems get better, it is still hard to predict.

Keywords: real estate, bubble, 9/11, government, market

"bubble" and collapse 3

Through the 1990s and into the 2000s, "the Department of Housing and Urban Development raised the quotas seven times," so that in the 2000s more than 50 percent of all the mortgages Fannie and Freddie acquired had to be made to home- buyers who were at or below the median income.

To make mortgages affordable for low-income borrowers, Fannie and Freddie reduced the down payments on mortgages they would acquire. "By 1994, Fannie was accepting down payments of 3 percent and, by 2000, mortgages with zero-down payments. "Although these lenient standards were intended to help low-income and minority borrowers, they couldn't be confined to those buyers. Even buyers who could afford down payments of 10 to 20 percent were attracted to mortgages with 3 percent or zero down.

"9/11 Attack" reduced real GDP growth in 2001 by 0.5% and increased the unemployment rate by 0.11%. Many people shifted stock market money into...