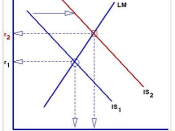

An Advantageous Alternative to the IS-LM Model For over fifty years now, the IS-LM model has been used as a critical model to teach and understand certain basic principles of macroeconomics. The model graphically depicts how the equilibrium in savings and investments meet in the economy to create a downward sloping, IS curve. This curve intersects with the upward sloping LM curve, the equilibrium between money supply and money demand in the market. That intersection is where the interest rate, located on the vertical axis, and output, located on the horizontal axis, for that particular market are determined (see figure 1). An increase in government spending or lowered taxes shifts the IS curve to the right, increasing the interest rate and output. Alternatively, an increase in the money supply shifts the LM curve down, lowering the interest rate and output. Although the model is simple and logical, several economists have criticized it for either lacking basic microeconomic foundations, for assuming too much price rigidity, or because it "simplifies the economy's complexities of a handful of crude aggregate relationships"� (Romer, 149).

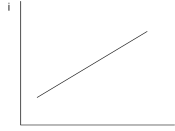

In addition to the above stated, the model is also not completely universal. Another reason the model is criticized id because it fails to distinguish between real and nominal interest rates. The IS-LM model was effective when studying the U.S. economy of the 1960s and 1970s. However, the monetary and fiscal policies of that time are not similar to other eras in studying Macroeconomic policy and decision-making. Romer's paper "Keynesian Macroeconomics without the LM curve,"� discusses how the IS-LM model is not the best alternative to study short run fluctuations and policy analysis. Romer's alternative model assumes the central bank does not target changing the money supply, as the IS-LM model suggests, but rather that it follows a real interest...