1. Why is Warburg, Pincus proposing a different fee structure from the standard arrangement?

A five forces analysis of the Private Equity Industry reveals that Warburg is shifting its fee structure to take advantage of limited customer bargaining power from its customers while trying to finance its access to increasingly scarce investment opportunities and deny it to its rivals through a price-war.

Warburg, Pincus is proposing to shift its fee structure by lowering its carried interest from 20 to 15% of any capital gain while rising its management fee from 1 to 1.5% of committed capital. Meanwhile, it aims at raising a record-breaking $ 2 billions "mega-fund".

One explanation is that Warburg is opting for a low price / high volume fundraising strategy. However, this does not hold since Warburg would be better off (except when assuming a low 5% annual return on investment) raising a fund similar to its 1989 one in both size and fee structure.

More convincingly, Warburg may be on the look-out for a price war. Indeed, both its management fee and carried interest are now in the lower end of market range. The usual carried interest is overwhelmingly at 20%. The median management fee is 2% for large funds (see exhibit 6) and 2.5% for smaller ones. Interestingly Warburg has now aligned its price structure at least 25% below the market average regardless of the expected return on invested funds. The increase of its management fee may only signal that it was historically abnormally low compared to market averages.

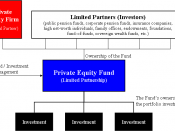

Another possible explanation is that Warburg is addressing the agency problem between general and limited partners. The case provides evidence that it exists some gap between the announced returns of Private Equity's funds and the actual returns cashed in by limited partners. Warburg may recognize...

I'd like to see this on my table...

If an assistant wrote this report...I'd like to see it on my desk..it is brief, to the point, but describes it's subject satisfactorily...

Good Job.

1 out of 1 people found this comment useful.