Introduction Businesses are increasingly dependent on the effective use of computers. It is therefore important to understand what the economic impact is that computers have on businesses. Computer industries expanded more slowly during decades previous to the 1990s, which was consistent with the rate at which prices dropped. Productivity growth has correlated with the rate of rapid technical improvements in semiconductors. These improvements have led to cheaper production of faster processors, which resulted in productivity growth and economic growth. This paper will outline changes in productivity, changes in computers and their relation to economic growth on the economy of the United States.

Productivity Analysis of the impacts of information technologies on productivity suggests a significant increase. For businesses, the benefits of information technologies require the use of innovation and reconfiguration of existing computers rather than the purchase of new hardware. Due to this situation, it is difficult to judge the impact of investments on economic growth.

Research has shown it is the systemic nature and the interdependent elements that make information technology investments productive.

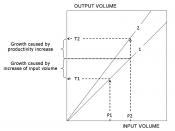

The analysis of productivity trends can be used to predict potential economic growth. Sustainable growth is determined by long-term productivity gains. By analyzing productivity developments, limitations that stand in the way of productivity can be eliminated.

Impact on the Economy The "New Economy" theory is based on the assumption that information technologies change the productivity growth rate of the economy. If so, increased investments in information technologies should increase productivity and economic growth.

Advances in information technology can be credited to advances in the production of semiconductors. Productivity of information technologies is affected by the current cycle of semiconductor production. Dale Jorgenson makes the argument that rapid productivity increases in the United States during the 1990s resulted from accelerated product cycles in the semiconductor industry.

Competition in semiconductor sales led to the departure from the traditional three-year semiconductor product-introduction cycle to a temporarily two-year cycle. This resulted in the introduction of new technology to consumers at a faster rate than in previous years. Businesses and consumers were presented with more advanced technology sooner than in the past.

Productivity Growth Robert Solow's 1987 statement that computers can be seen everywhere except in the productivity statistics has become known as the "productivity paradox" -- referring to the absence of productivity gains in the 1970s and 1980s as technology advances were taking place. Studies on information technologies' productivity impact in the 1990s revealed computers had major positive productivity effects. However, these studies showed that productivity changes become visible only after a delay. Additionally, organizational changes and acquired skills and experiences are required for productivity benefits to take place. Organizations must adjust their operations to take advantage of the productivity potential of new technologies for investments in information technologies to become productive. This view suggests that productivity impacts are not guaranteed by investment in information technologies alone, but by when they are accompanied by changes in organizational practices.

After a business has made adjustments to its operations to take advantage of its productivity potential, productivity impacts can be expected to become visible. Toward the end of the 1990s, a widely accepted view emerged that the productivity paradox was a temporary event and that computers and other information technologies had become one of the main drivers of economic and productivity growth. Rapid declines in price for computer equipment and semiconductors were an important force in the process. Dale Jorgenson states, "Despite differences in methodology and data sources, a consensus is building that the remarkable behavior of prices provides the key to the surge in economic growth." In addition, Robert Gordon goes on to state:"⦠Consensus emerged that the technological revolution represented by the New Economy was responsible directly or indirectly not just for the productivity growth acceleration, but also the other manifestations of the miracle, including the stock market and wealth boom and spreading of benefits to the lower half of the income distribution. In short, Solow's paradox is now obsolete and its inventor has admitted as much." (Gordon, 2003)The result is that increased information technologies investment brought about an increase in productivity and especially in manufacturing in the 1990s. Dale Jorgenson and Kevin Stiroh called these impacts on information technologies the "Phlogiston Theory of New Economy" and state:"... The evidence already available is informative on the most important issue. This is the 'new economy' view that the impact of information technology is like phlogiston, an invisible substance that spills over into every kind of economic activity and reveals its presence by increases in industry-level productivity growth across the U.S. economy. This view is simply inconsistent with the empirical evidence." (Jorgenson and Stiroh, 2000)Analysis has revealed differences between productivity studies conducted in the United States and those conducted in other countries. The data did not find a positive impact from information technologies investment on economies in Europe. Overall productivity growth slowed down in the 1990s in Europe. However, there were different methods of calculating computer prices, and some researchers claim that this was the cause of the so called Solow paradox, which refutes the claim of productivity gains from increased information technology investment. Gordon, meanwhile, observed that:"These results imply that computer investment has had a near-zero rate of return outside of durable manufacturing. This is surprising, because 76.6 percent of all computers are used in the industries of wholesale and retail trade, finance, insurance, real estate, and other services, while just 11.9 percent of computers are used in five computer-intensive industries within manufacturing, and only 11.5 percent in the rest of the economy. ... Thus, three-quarters of all computer investment has been in industries with no perceptible trend increase in productivity." (Gordon, 2003)Some economic researchers state that studies don't find any influence by information technologies. O'Mahony and Vecchi argue that standard econometric approaches show negative impacts by information technologies on output and productivity growth, and that this is caused by industries where information technologies have different impacts. They also stated that most studies on information technologies have assumed that the impacts of information technologies have remained the same during the last decades.

Researchers agree that several important conceptual issues still require clarification. A decline of Internet-based businesses at the beginning of the current decade also brought about questions of the sustainability of the productivity patterns seen in the end of the 1990s. The United States Congressional Budget Office stated in its report on information technologies productivity impacts, "In contrast to the unanimity about the effects of computer hardware manufacturing, no consensus exists yet on the degree to which computer use has boosted total factor productivity growth." (2000) Renuka Mahadevan states, "Expert opinion is solidly divided on the productivity debate. One view is that the productivity paradox exists, and the other that there is no such paradox." (Mahadevan, 2002)Total factor productivity growth was on the decline in the 1970s despite breakthroughs in technology; however, this changed in the 1990s. During the 1990s productivity grew in the United States at nearly twice the average of the preceding 25 years. According to studies, the main sources for productivity growth were increased investments in information technologies and improvements associated with technical progress and information technologies use. The productivity growth was also focused on information technologies producing businesses and on businesses that used information technologies. The use of computers greatly increased productivity in the companies that used them. It is unclear why the productivity paradox had originally appeared. The paradox no long exists and the reason for it no longer appearing is unknown.

Price and its Relation to Growth Prices for consumable items can be tracked over time. For such items price researchers can develop price indexes. Matched model price indexes are used by price researchers to compare the price of items over time. The use of matched model indexes on computer products encounter problems, though. New computer models and versions emerge frequently, and completely new functionality is regularly introduced in information technologies products. Few product models exist on the market long enough so that matched model price indexes could reliably be developed for them. The use of the matched model approach does not work well for computers. The approach cannot count new products that do not have historical data.

The hedonic method tries to overcome the problems of matched model comparisons by creating statistical estimates of the value of product characteristics. Price researchers can observe the prices of ten different computers that are otherwise similar, except that they have hard drives that are of different capacity. Researchers use a statistical model that estimates the current market value of a computer by comparing the use of pricing and hard disk capacity. This approach can be used for multiple characteristics of computers such as processor clock speed, amount of random access memory, CD drives, and hard disk size. This allows the development of a mathematical model that describes how the different technical configurations influence the price of the computer.

Through the use of the hedonic equation, one can insert specifications and it will indicate how much the product will cost. Hedonic equations can give prices for products that do not exist on the market. They can indicate what the price of a product model would have been if exactly that model would have been on the market in the past. Price difference can then be used to determine a price index for that product. The same method can be used to determine a price index for products that consist of bundles of different items, and the estimated price change of these bundles gives a "quality-adjusted" or "constant-quality" estimate of price change.

Computer prices are adjusted for quality improvements. It is, therefore, an important measurement of growth. In other information technologies products and services, the adjustments have been less prominent. U.S. price indexes for computers, software and other products have shown price indexes are commonly used as the starting point in international information technologies productivity studies. Productivity growth in the 1990s is in part due to the decline in prices of computers -- rapid productivity growth in the 1990s was a result of the rapid decline in computer price indexes. In productivity studies, this decline becomes extremely important. It affects both the growth rate of quality-adjusted productive assets and the user costs that multiply the growth of these assets. Also the user cost is calculated by multiplying the total quality-adjusted volume of productive assets and its gross rate of return, which depends on the rate of quality-adjusted depreciation and revaluation of the assets.

The reason why productivity studies find information technologies as the driver of productivity improvements, therefore, is to be found in the fact that accounting studies allocate productivity growth to those sectors where productive assets grow fast and where price declines are rapid. Quality adjusted prices have led to growth in productive computer assets. The contribution of information technologies to labor productivity has been large as the rapid increase of computer assets translate into increased capital. Industries in which price indexes decline are necessary for productivity growth. As such, these results follow purely from the mechanics of growth accounting, and there is nothing that would differentiate information technologies in this framework from any other products that have similar price dynamics.

The value of computing assets in the United States has doubled since the 1980s. The value generated by computing services has grown rapidly over the past two decades. This rapid growth has been the main source of research results that show that information technologies became important for economic growth and productivity improvements since the 1990s.

ConclusionThis research proposal has focused on an analysis of the role increased use of computers has played in increasing economic productivity. Computer have impacted the economy very significant. Much of the current knowledge about the impact of information technologies on productivity and growth is based on a growth theory that explains how advancements in technology will lead to economic growth. Economists describe the impacts on productivity in studies that have analyzed the impact of information technologies on growth in the United States in recent decades. These studies have shown that the use of computers has significantly increased productivity. Computer price index changes have created the main source of growth since the 1990s. As the price of computers and semiconductors has declined and advances in the use of computers has risen, the effect has been substantial: Increased productivity has lead to a significant positive economic impact on the economy in the United States.

References: Bartelsman, E.J. and Doms, M.(2000). "Understanding Productivity: Lessons from Longitudinal Microdata," Journal of Economic Literature, volume 38, number 8, pp.569-594.

Baumol, W.J. (2002). The Free-Market Innovation Machine: Analyzing the Growth Miracle of Capitalism. Princeton, N.J.: Princeton University Press.

Bresnahan, T.F. and Malerba, F.(1999). "Industrial Dynamics and the Evolution of Firm's and Nations' Competitive Capabilities in the World Computer Industry," In: D.C. Mowery and R.R. Nelson (editors). Sources of Industrial Leadership: Studies on Seven Industries. Cambridge: Cambridge University Press, pp. 79-132.

Brown, J.S. and Duguid, P. (2000). The Social Life of Information. Boston: Harvard Business School Press.

Brynjolfsson, E. and Hitt, L. (2000). "Beyond Computation: Information Technology, Organizational Transformation and Business Performance," Journal of Economic Perspectives, volume 14, number 4, pp23-48.

Gordon, R.J. (2003). "Hi-Tech Innovation and Productivity Growth: Does Supply Create its Own Demand?" NBER Working Paper Series, Working Paper number 9437. Cambridge, Mass.: National Bureau of Economic ResearchSaxenian, A. (1999). Silicon Valley's New Immigrant Entrepreneurs. SanFrancisco: Public Policy Institute of California.

Jorgenson, D.W. and Stiroh, K.J. (2000). "Raising the Speed Limit: U.S. Economic Growth in the Information Age," OECD Economic Department Working Papers, number 261Mahadevan, R. (2002). New Currents in Productivity Analysis: Where to Now? Tokyo: Asian Productivity Organization.

Grochowski, E. and Halem, R.D. (2003). "Technological Impact of Magnetic Hard Disk Drives on Storage Systems," IBM Systems Journal, volume 42, number 2, pp.338-346.