A.

BACKGROUND

Laser Engineering is a wholly owned subsidiary of Lightray Inc., a company listed on the New York Stock Exchange. Laser Engineering is a company which manufactures and retail distribution of high technology engineering equipment. Laser Engineering is an Australian based company which has two subsidiaries, Ace Supply Pty Ltd and Bell Manufacturing Pty Ltd. The Board of Directors of Laser Engineering consists of two directors of Lightray Inc. and three Australian directors, Sandra Thomas (Managing Director), Bill Jackson (Finance Director) and Dave Chan (Operations Director).

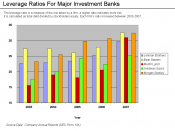

In terms of capital structure, the company relies significantly on the equity rather than debt in the year 2003. On the contrary, the company relies heavily on debt in the year 2004. By looking at the figure in the Draft Statement of Financial Position, this may increase the risk of going concern problems which will be discussed later. Being a high technology company, it may expose to high inherent risk, because of the complexity of valuation of Research and Development.

The Research and Development cost has been capitalized even though the sales of the new machine have been disappointing.

SWOT ANALYSIS

Potential internal strengths

1. Adequate financial resources by the parent company in the United States.

2. Cost leadership concentrating on a new machine which is more accurate and much cheaper than others already available in the market.

Potential internal weaknesses

1. High debt to equity ratio (Appendix 1).

2. Obsolete stock of machines which are out-dated may affect the inventory turnover ratio and return on total assets.

3. Poor quality of employees specifically on hiring the temporary accounting staff. There is a likelihood of fraud to be committed.

4. Lack of integrity and objectivity of management as management is potentially biased as they have an incentive to prepare a report that...