ÃÂIncome is the amount of funds or other benefits, flowing to individuals or households from the sale of factors over time.

ÃÂWealth is the value of accumulated assets over time.

ÃÂIncome inequality refers to the degree which income is unevenly distributed among people.

ÃÂIncome distribution is measured through:* The Lorenz Curve ÃÂ a representation of the degree of income inequality through a level of deviation of the distribution of income from a line of absolute equality amongst income earners.

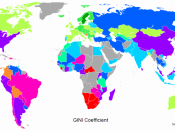

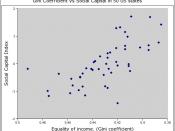

* The Gini Co-efficient ÃÂ a mathematical indicator if the degree of income in equality, represented by a number between 0 and 1, where the closer to 1 the greater the inequality.

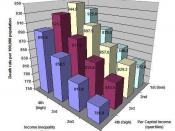

TRENDS IN INCOME & WEALTH:ÃÂVaries according to age, gender, occupation, ethnic background, family structure & geography* Age: incomes rise until retirement ÃÂ 45-55 yrs receive approx. 2.5x the income of 15-24 yrs* Gender: women receive 80% of menÃÂsÃÂ ÃÂ P/T occupations* Occupation: Labourers (mean income $412) and managers & administrators ($1187) (2000).

* Ethnic Background: ability to speak English, skills & education.

* Family Structure: single parent familles vs. married coupled families* Geography: on average NSW ($482 p/w) and TAS ($391) (2000).

COSTS & BENEFITS OF INCOME INEQUALITYÃÂEconomic Benefits:* Encourage labour force to improve their education & skills ÃÂ better rewards as incentive* Encourage workers to work longer hours ÃÂ higher incomes and so higher EG* Encourage entrepreneurs to accept more risks ÃÂ vital to increase productive capacityÃÂEconomic Costs:* Inequality can reduce EG* Reduces consumption & investment* Increased poverty & social problems are expensive to solveÃÂSocial Benefits* Very LimitedÃÂSocial Costs* Social class divisions ÃÂ rich doesnÃÂt associate with poor* PovertyGOVERNMENT POLICIES TOWARDS INCOME INEQUALITYÃÂDirectly:* Fiscal Policy ÃÂ through govt. taxation and spending, redistributes income amongst poor. Recent push in fiscal balance has led to a reduction of this* Changes To...