Before an analysis of potential stocks for a portfolio can be undertaken, one must first analyze the environment in which the respective companies conduct their business. First, I want to elaborate on the state of the economy as a whole before I will focus specifically on the automobile industry and its particular role within the American economy at present.

Economic Analysis

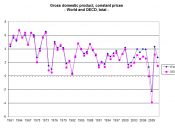

The American economy is entering 1998 in its 8th year of economic expansion. Surprisingly, a real downward trend is not in sight; to the contrary, the prospects for the economy are still very promising. The numbers are impressing, considering how long the economic upturn has been: e.g. the inflation rate is stable at 1.7%, unemployment is at its lowest level in over 20 years (4.7%), and the consumer confidence in the economy is still very high.

The near future also looks rosy: producers' durable equipment spending is expected to rise by 10%, indicating that the economy is still anticipating an upward trend.

In fact, industrial production is expected to rise at a rate of 4.2% for 1998. GDP growth is expected to lie between 2.5 and 2.8% for '98 only a moderate decline from 1997's over 3%. The same goes for the unemployment rate, which is projected to remain fairly stable at 4.7-4.8 %.

As far as interest rates and inflation are concerned, 1998 looks very promising: A moderate increase in the CPI to roughly 1.9% is expected, a very low figure, considering the late stage of economic growth. Some experts believe the rate of inflation might rise as much as 4% over the year, though. They expect a continuing rise in wage levels, which already rose by 3-5% over the last few months. As these higher compensation costs are usually passed along in the form of higher prices,

The Automobil industry

very good informaion and accuracy. This is a good report for anybody needing data and accuracy

1 out of 1 people found this comment useful.