After occupying the new position as an assistant financial advisor at Caledonia Products, I was asked to assess the new investment projects that Caledonia was considering. To get a clear and exact picture, I hired a professional team in order to do the calculation of the cash flow associated with new investment under my supervision. Therefore, the team will evaluate two mutually exclusive projects and provide an explanation about which one of those projects will assure the best investment for the company. The calculation of the payback period of each project, the net present value, and the internal rate of return will help the team deciding which project should be acknowledged, and what aspects the company would need to consider with the leasing option.

Analysis of the Two ProjectsProject A and Project B are both 5-year, mutually exclusive projects with $100,000 initial outlay. Project A's cash flow is $32,000 each of the five years while Project B's cash flow is $200,000 in the fifth year of the project (see Table 1).

YearProject AProject B0-$100,000-$100,000132,0000232,0000332,0000432,0000532,000$200,000Table 1To determine which project is best for Caledonia, several variables must be considered. These variables are payback period, net present value (NPV), and internal rate of return (IRR). Once these values are calculated, the projects must be ranked. Finally, the better project for Caledonia can be chosen.

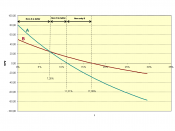

The payback period is the "number of years needed to recover the initial cash outlay of the capital budgeting project" (Keown, Martin, Petty & Scott, 2005, p. 292). For Project A, the payback period is 3.125 years while Project B's payback period is longer at 4.5 years. The NPV of a project is the present value of the project's cash flows less the initial cash outlay. The NPV of Project A is $18,269 while the...