Upon acquiring a new position as an assistant financial analyst with Caledonia Products, the boss has requested an evaluation of two mutually exclusive projects that may be considered as potential additions to the organization. In order to complete this assessment this paper will explore the capital budgeting process of Caledonia and will answer five specific questions from the Financial Management: Principles and Applications text. What is each project's payback period? What is each project's net present value? What is each project's internal rate of return? What has caused the ranking conflict? Which project should be accepted and why should that project be accepted? Finally, this paper will end by weighing the prospect of purchasing versus leasing so that Caledonia can make an educated decision regarding their decision.

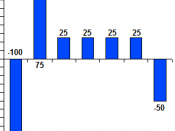

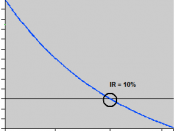

a)Payback period for Caledonia Products is as follows:Project A = 2 yrs + (32000/ (100000-64000) yrs = 2 + 0.89 = 2.89 yearsProject B = 5 yearsb)Net Present Value for:Project A = Sum of all net present value - Initial cash outlay = 1213005 - 100000= 21305Project B = 124184 - 100000 = 24184c)Internal Rate of Return (IRR)IRRA = 18%IRRB = 15%d)The time disparity has cause the ranking conflict in mutually exclusive projects.

The reason is the different reinvestment assumptions made by the net present value and internal rate of return (Keown, Martin, Petty, & Scott, 2005). "The NPV assumes that cash flows over the life of the project can be reinvested at the required rate of return or cost of capital. The IRR criterion assumes that the cash flow over the life of the project can be reinvested at the internal rate of return" (Keown, Martin, Petty, & Scott, 2005, p 348). The firm rate of working capital is 15%. The NPV Project B is better whereas the IRR indicates...