Capital structure refers to the proportion of financing from debt and from equity capital (D/E ratio). An efficient mixture of capital reduces the price of capital. Lowering the cost of capital increases net economic returns, which, ultimately, increases firm value. There are a number of theories that explain capital structure, namely, M&M, Static Trade-off Theory and the Pecking Order Theory.

M&M theory assumes that the market is in a perfect capital market status as no transaction or bankruptcy costs, asymmetric information flow, firms and individuals can borrow at the same interest rate, no taxes and investment decisions are not affected by financing decision. All these assumption made firms away from the impact of different level of debt and equity. Their two 'propositions' were about the value of company is independent of its capital structure and the cost of equity for a leveraged firm is equal to the cost of equity for an unleveraged firm, plus an added premium for financial risk.

However, imperfections exist in the real world so that we need trade-off theory and the pecking order theory to explain more.

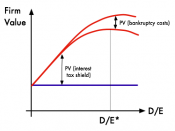

The trade-off theory begins with the idea of an optimal capital structure. When a firm's debt increases, the accompanying tax advantages increase and tend to offset the firm's debt-related, expected costs of financial distress and bankruptcy. With additions to debt at relatively low levels of debt, the tax advantages increase faster than expected financial distress costs, therefore, the value of the firm increases. However, if the debt level continues to increase beyond the optimal debt level, then the increasing marginal expected cost of bankruptcy more than overcomes the marginal debt related tax advantage and the value of the firm declines. (Claggett, 1991)The Pecking Order theory suggests there should be a preferred hierarchy for financing decisions. Internal financing...