Overview

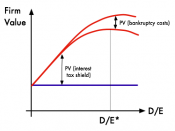

MCI Communications Corp., a long-time client of Lynch Investments is inquiring about establishing a program to repurchase some of its outstanding common stock. Their stock has been somewhat "sluggish, in an otherwise buoyant market, and has indications that stockholders are becoming restless from the corporation's lack of stable growth" (MCI Communications Corp. Case, 2004). An earlier meeting held by MCI, an idea was proposed for the company to repurchase some of its outstanding common stock, which would increase MCI's debt financing and would eventually double the current debt to equity ratio almost to 80%. To repurchase to stock, MCI would be required to take on an additional $2 billion in debt. This will "give the perception to the market that the company was performing well and therefore, increase both interest and sales for their stock." (MCI Communications Corp. Case, 2004)

Some feel that this approach is too drastic and proposed an open-market purchase program, that will allow the company to repurchase their own stock but only when corporate funds would enable them.

The upside to this approach is that would not require such a large increase in debt for MCI. The downside is that it might not give immediate results in regards to gaining interest in the stock.

1.) What would be the effects of issuing $2 billion of new debt and using the proceeds to repurchase shares on the following:

÷Book value of MCI equity

÷Price per share of MCI stock

÷Earnings per share of MCI stock

By using the $2 billion in additional long-term debt would increase the debt-equity ratio in terms of book value from 41.1 % (3,944/9,602) to 51.9 (5,944/7,602). MCI should use the debt and equity's market value, not book value in order to determine their debt-equity ratios for...

Kudos!

One of my class mates pointed out this article to me for project we are doing in the same vein. I thought it was an excellent start for us non-finance majors. By viewing someone else's perception of the case will save us hours of research time! So far this article is proof that I got the best ROI from joining this website! :)

3 out of 4 people found this comment useful.