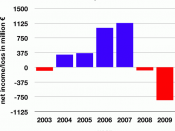

INTRODUCTIONBaker Company Limited (BCL), a retail business, was founded in 2003 and was able to accumulate small profits in its first and second year of operations. However, the economy was hit with a recession in 2004 which resulted in slow consumer spending. The recession caused several retail companies to go bankrupt, but BCL managed to stay in business. However, BCL suffered some operational losses in 2005. As a result, BCL's management team must decide how to treat the tax benefits that arise from these losses.

ANALYSISIn 2006, the recession lessened, but the economy is still affected by high unemployment and low consumer spending. However, BCL management is optimistic about the company's future performance. The recession eliminated some of its competitors, and BCL is planning on introducing two new products in 2006 for which buyers are already lined up. BCL must now decide on how to treat the operational losses incurred in 2005.

Although it is evident that a loss carryback should be utilized, the main issue is when to recognize the tax benefit of a loss carryforward, given that there are remaining profits after the loss carryback.

Constraint and Decision CriteriaBCL is publicly traded, and therefore it must abide by Canadian generally accepted accounting principles (GAAP). The alternatives to recognize a loss benefit in the current year or in future years should be evaluated based on several decision criteria. These include the principles of conservatism and reliability. The losses should be accurately represented taking into consideration the arguments from both the economists and BCL management. In addition, the likelihood of BCL earning profits in upcoming years needs to be examined. If it is more likely than not that BCL will be profitable in 2006 then the tax benefit should be recognized in the loss year.

Alternatives and EvaluationIn...