AA312

Case: Birch Paper Company

1. Calculating all three options based on costs

Thompson DivisionCosts

Linearboard and corrugating medium 168(70%*400)*60%

30% of out of pocket costs 120(30%*400)

Total 288

West PapersCosts

Total 430

Eire PapersCosts

Outside linear(Southern div) 54(60%*90)

Printing(Thompson div) 25

Own Supplies 312(432-5-36)

Total 391

As shown in the calculations above, Northern should accept the bid from Thompson division as it has the lowest cost if all transfer prices within the company were calculated at costs. Incurring the lowest costs would also enable Birch Paper Company to earn the highest profits possible.

2. As alternatives for sourcing exists, Mr. Kenton should be permitted to choose the alternative that is in Northern division's own interests. The transfer price policy gives him the right to deal with either insiders or outsiders at his discretion. If he is unable to get a satisfactory price from the inside source which is Thompson division, he is free to buy from outside.

Mr. Kenton, manager of the Northern division should not accept the bid from Thompson division. The three bids from Thompson division, West Paper Company and Eire Paper Company are $480, $430 and $432 respectively. Accepting the bid from Thompson division would be accepting the highest bid amongst all three offers (highest costs). This would result in the lowest profits. As the Northern division is evaluated as an investment center, it is judged independently on the basis of its profit and return on investment. Mr. Kenton should not accept the bid from Thompson division.

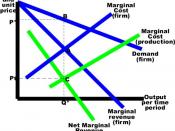

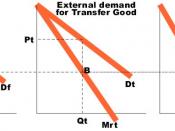

3. The method of using transfer price to decide whether to in source is optimum if the selling profit center can sell all of its products to either insiders or outsiders and if buying center can obtain all of its requirements from either outside or insiders. The market price...

Dysfunctional transfer pricing

The essay does not talk about why the transfer pricing system is dysfunctional. This is a very important part of this case.

2 out of 3 people found this comment useful.