China set to cool off its Growth.

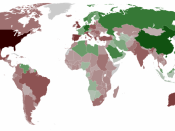

China is experiencing large economic growth to the point where it may not be sustainable without equally large inflation. But any reduction in rate of Chinese economy's growth will have little effects on neighboring Asian economies due in part to the current and anticipated growth of both U.S. and Japanese economies anticipated.

It appears that the Chinese government is trying to take preemptive, measures to cool off the "overheated" economy. "There are some signs of overheating," International Monetary Fund chief economist Raghuram Rajan said. The central bank has just tightened credit again and even though this might not be enough to slow the investment rush, it is certainly indicates a general and further tightening with another rise in interest rates probably next in their plans.

If China increase their interest rates this will mean that they are effectively decreasing their money supply which will effectively lower the quantity demanded of Chinese currency Yuen.

One of the major limitations with such policy adaptations is the lag time associated with implementation and recognition. It may be not until mid 2005 that the effect of these changes is seen.

There is a risk of a reoccurrence of the bursting of the bubble of investment that occurred in the Asian crisis in recent years.

China has fixed exchange rates which are artificially held below market value, Capital markets are essentially deregulated and are currently experiencing a boom in foreign and domestic investment, the interest rates and banking system are being controlled by the government and the level of offshore financial borrowing is high.

China has many problems. With growth accelerating, their economy is in danger of overheating, which could generate inflation. The banking system is weighed down by between 40% and 50% of nonperforming loans, financiers...