�PAGE � �PAGE �4� Case Analysis: Clarkson Lumber Company

Running head: Case Analysis: Clarkson Lumber Company

Case Analysis: Clarkson Lumber Company

Frank Foltyn

University of Maryland University College

TMAN 625 section 9044

September 10, 2007

1. Why has Clarkson Lumber borrowed increasing amounts despite its profitability? There are a couple of reasons for Mr. Clarkson wanting to increase the amount of borrowing that would be needed to continue with his operations. One of the reasons is that he wants to pay off Mr. Holtz in order for himself to become the primary owner of the company. Another reason for the need to borrow funds is that the net income was growing at a slower rate than the operating expenses. Between the years of 1993-1995 the net income only rose from 60k, 68k ,77k thousand respectively. The operating costs for the 3 years rose from 622k, 717k, 940k thousand respectively. Mr.

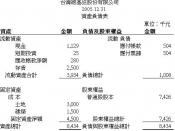

Clarkson needs to take out a loan so he could increase the purchasing power for goods. This would be accomplished by Mr. Clarkson having liquid cash to use for prompt payment, which will lead to acquiring trade discounts and then Mr. Clarkson will have a competitive advantage in terms of buying power. 2. How has Mr. Clarkson met the financing needs in the past? The financing needs of the past have been met by taking a term loan of $399,000 that was fixed by the assets the company had. Mr. Clarkson had control liabilities that were offset by the increase in sales. 3. How much will Mr. Clarkson need to finance the expected expansion in sales to $5.5 million in 1996 and to take all trade discounts? Based on the pro forma balance sheet and the pro forma income statement, Mr. Clarkson would need $750,000 loan. This would be justified...

Clarkson lumber company

Hey, good essay.

0 out of 0 people found this comment useful.