Whether a business is privately or publicly owned, regulated under a number of United States Government compliance laws, corporations should follow due diligence and incorporate internal controls to ensure accountability in their financial reports. Management is the first line of defense in maintaining the truthfulness in finance of the company. Managers must be alert to the accounting system that is at hand, without this first line awareness, rudimentary protection of the company financial reports would be at risk.

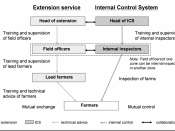

In being in the trenches, so to speak, managers need to know the features of the accounting systems that are in use at the company and its controls ( Noordin, 1997). Some of these features include having reliable personnel with clear responsibilities, separation of duties, proper authorization, adequate documentation and cost benefit analysis ( Noordin, 1997). Record keeping is absolutely an essential in conducting business, whether the company is enterprise or small business, records are the core of maintaining accountability in day-to-day activities.

Having effective internal control techniques is important in keeping the company books "under control," and companies are including the specific controls that are employed in their annual reports, this is considered a good corporate governance practice (Willis, et al, 2000). Even the Security Exchange Commission (SEC) and Financial Accounting Standards Board (FASB) do not require the publishing of the internal controls in the annual report of the company. Over the last ten years, auditors and preparers have reached agreement on some of the routine internal control items to be included in the annual reports (Willis, et al, 2000). These reports now include the following topics within the body of the published works: Financial statement presentation; Purpose, nature and components of the company's internal controls; role of the internal audit, role of the audit committee, role of the independent auditor...