Today our economy is in a tail spin between greed from such corporate giants as Enron, WorldCom, and the nonsense lending from our leading institutions such as Fannie Mae, and Freddie Mac. Our country has lost sight of what the American dream was based on. We have allowed a chosen few to over spend rip us off as a nation break our banks, and then ask us to bail them out on the backs of the tax payer.

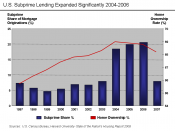

Congress passed a $700 billion rescue bill early this year Part of a sweeping $1 trillion government plan to calm the stock market and unfreeze credit - the unprecedented rescue came amid mounting fears of a deep recession. The government's efforts included the federal takeover of mortgage giants Fannie Mae and Freddie Mac, which together hold or guarantee $5.4 trillion in mortgage loans - 45 percent of the national total. The quasi-governmental firms were dragged down by investments in subprime mortgages and other "toxic" financial instruments.

Meanwhile, even as the Bush administration and congressional leaders were calling the bailout plan vital, fundamental questions were being raised, including: Is the bailout big enough? And did risky lending by Fannie and Freddie and poor regulatory oversight fuel the crisis, not only did Fannie Mae along with Freddie Mac put the proverbial icing on the cake, but the start of our economy collapse began with two even bigger corporations: Enron and WorldCom.

Jack Welch was CEO of General Electric from 1981 to 2001 he wrote the book "Not Every Business Is an Enron." Welch, stated "Criminal wrongdoing on the part of a few executives has led to a widespread loss of morale and confidence in the American business community. "Enron bought the shares of National Westminster Bank (NatWest) in a limited...