University of PhoenixOctober 12, 2009ACC/400IntroductionThe purpose of this paper is to conduct a comparison of current and noncurrent assets; in addition this paper will also explain order of liquidity and how the liquidity applies to the balance sheet.

Current and Noncurrent AssetsAccording to Kimmel, Weygandt, & Kieso, (2007), two types of are assets are present at all companies current assets and noncurrent assets. Current assets are assets that a company expects to convert into cash within a year or less. Current Assets on a balance sheet item equals the sum of cash and cash equivalents, accounts receivable, marketable securities, prepaid expenses and Inventory all fall under the category of current assets since most or all companies expect to convert to cash within a year or less. Noncurrent assets are assets that a company does not expect to convert into cash within a year or less. Office Furniture, business equipment trademarks a copyrights fall under the noncurrent assets category.

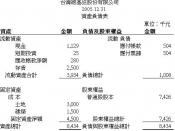

The difference between current and noncurrent assets is the time that it takes for those assets can be converted into cash, if they can even be converted into cash. Current and Noncurrent assets are usually listed on a company's Balance Sheet. The Balance Sheet is one of the most important financial statements prepared by companies on a yearly. The Balance Sheet is an outline of the company's financial condition. The balance sheet shows in a nut shell a summary of company assets. Liabilities and shareholders' equity.

Many companies delete current assets on balance sheets after a year from the data on the balance sheet. Kimmel, Weygandt, & Kieso (2007) Accounts receivable are current assets because companies will acquire them and convert them to cash within a year or less. Supplies are a current asset because the company expects to use them for...