� PAGE \* MERGEFORMAT �3�

Current market crisis

The house is the biggest asset for most of household; therefore, the price is very important and any adjustment in the housing sector will affect the economy and the financial markets. The existing crisis which has already flooded the entire economy is often referred to as subprime mortgage meltdown. The reason behind creating Government Sponsored Enterprises (Fannie Mae and Freddie Mac) was to avoid massive defaults in residential and commercial housing. Given that federal government took steps to provide stability to the financial markets, mortgage availability and protecting taxpayers.

The current decline of the securities industry is just a consequence, tied directly with the original issue of the fall of the United States housing system, which has passed through several stages, exposing market players and the government to new challenges and difficulties.

Primarily, it is important to understand the roots of the crisis, which consist in the boosting of the American housing.

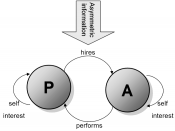

Given that with the beginning of the new millennium, the population's income has risen dramatically, all financial institutions, eligible to provide housing loans, began to accept increasingly more critical moral hazards, i.e. began to lure those borrowers who were not qualified enough for such a huge loan. The frequency of principal-agent problem cases had also grown substantially. In economics, "the principal agent problem treats the difficulties that arise under conditions of incomplete and asymmetric information when a principal hires an agent" (Fukuyama, 1995, p. 54). This model can be easily applied to the relationship between borrower and financial institution, in which the former conceals certain information about their spending plans and current financial situation and therefore are more likely to fail to return the loan. The popularization of housing loans subsequently caused the decline of risk premiums: "A study by...