EXECUTIVE SUMMARYD'Leon Incorporated is a small food producer that specializes in high-quality pecan and other nut products sold in the snack-foods market. In 2004, D'Leon's president, Al Watkins, decided to undertake a major expansion to become more competitive within their market. The following report describes some of the financial effects that this expansion has had on the company.

D'Leon began its expansion by doubling its plant capacity, opening new sales offices, and investing in an expensive advertising campaign. Watkins felt that they had superior products to the competition and that he could charge a premium price for their products to result in increased sales, profits, and stock price. The results, however, were unsatisfactory. Sales were below and costs were above all initial projections. These results have raised questions about the expansion and also caused concern among the Board of Directors and the major shareholders about the future of the company.

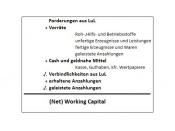

Part I of this report analyzes D'Leon's financial statements from 2004 and 2005. It describes some of the effects of the expansion on the financials of the company and some of the problems that have arisen with their current financial position. Net operating profit decreased, but operating working capital and total operating capital have shown increases. Sales had a considerable increase, but net income decreased. D'Leon's financials also indicated a decrease in cash flow due to the company spending more cash than they were taking in. These changes are subsequently resulting in decreased stock prices and a deteriorating financial position which is concerning both management and shareholders.

Part II of this report discusses the ratio analysis of D'Leon's financial statements. It begins by explaining the five major categories of financial ratios: Liquidity, Asset Management, Debt Management, Profitability, and Market Value. While most of the 2005 ratios have shown significant declines...