Dell, inc: Financial Ratio anaylsis

�

Dell, Inc. is a company that has been growing and doing really well in the production and selling of personal computers. Dell is in the technology sector and the personal computers industry. Dell engages in the design, development, manufacture, marketing, sale, and support of various computer systems and services to customers worldwide. It offers various products, including desktop computer systems and workstations; mobility products, such as notebook computers, mobile workstations, MP3 players, and handhelds; software and peripherals that consist of printers and displays, projectors, peripheral products, software titles, notebook accessories, networking and wireless products, digital cameras, power adapters, scanners, and other products; servers and networking products; and storage devices.

Dell also provides various services, including enterprise support; assessment, design, and implementation services; training services; and client support services. Further, it offers various financing alternatives for business and consumer customers in the United States, through Dell Financial Services L.P.

The company sells its products directly to large corporate, government, healthcare, and education accounts, as well as businesses and individual consumers. Dell operates principally in the United States, Europe, Middle East and Africa, and Asia Pacific-Japan. Dell's main competitors are IBM, Hewlett Packard, and Sun Microsystems. Their market capital is $66.56B compared to the $785.41M industry average. Their revenue for 2005 was over $49 billion. Their quarterly growth is 12.8% compared to the industry average of 13.6%, which is pretty good since they are currently operating at a higher rate than the industry.

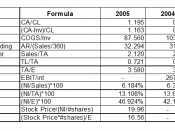

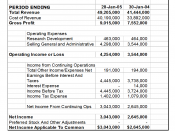

The financial ratios show that Dell is doing well. The current ratio is increasing, as it increased from 0.976 in 2004 to 1.195 in 2005, however it is still lower than the industry average of 1.8. The quick ratio is also increasing since it went from 0.946 to 1.163, which is only slightly...