Q3: Financing its growth in 1997 (Hint: exhibit-4 and 5)

Can be done by using projected financial statements

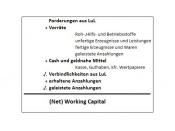

Working Capital requirements

Comparison of working capital improvements and profitability improvement

Forecast 1997 BS

Additional sales of $2648 million imply additional operating assets of $779 million.

In 1996, the 1997 profits would be $405 million.

AFN would be $315- current liabilities may affect AFN

For efficient management of working capital:

Improve margins

Reduce obselesce cost

Company can fund additional growth without funding from outside

A combination of WCM efficiency and profit margin improvement can fund growth, repayment of debt and buy back of shares

1) The first liability assumption is that liabilities remain fixed at 1996 levels. If the 1996 profit margin of 5.1% remains constant, profits will fund $405 million of the additional assets. Dell would require additional funding of $315 million.

1996 Profit Margin: Net profit/sales

= 272 000 000 / 5 296 000 000

= 5.136%

2) The second liability assumption is that liabilities remain at 1996 sales ratios. With this assumption, Dell has excess capital of $217 million. This is consistent with the adjusted sustainable growth calculations.

Sales of Liabilities= Total Liabilites x Sales Growth

= 1 175 000 000 x 0.5

= 58 750 000

Total liabilities in 1997: Profit Margin + % Sales of Liabilities + Short Term Investment

= 408 003 840 + 58 750 000 + 591 000 000 3) The third liability assumption is the repayment of debt and the repurchase of $500 million of equity. The other liabilities are assumed to remain at 1996 sales ratios. As a result of reducing debt and equity capital, Dell would create a substantial cash shortfall of almost $1 billion.

500 million +113 million + 779 million = If asked to choose between the three liability...