i Externalities are costs or benefits of production or consumption experienced by the society who are not directly involved or had not paid for it. It is sometimes referred to as 'spillover' or 'third-party' costs or benefits. (Sloman & Norris 2002, p567) A benefit experienced by the society or third-party who are not directly involved when a product or service is consumed or produced by a person or a firm is known as a positive externality. Examples of positive production and consumption externalities are education, health provision, vaccination and researching of new technologies.

Negative consumption externalities occur when the costs of consumption is borne by other people other than the consumer. (Sloman & Norris 2002, p271) The society would then prefer lesser of these kinds of goods and services to be consumed. Examples of negative consumption externalities are negative externalities created by smoking and alcohol abuse, pollution from cars and motorbikes, vandalism of public property, illegal racers and litter on street and public places.

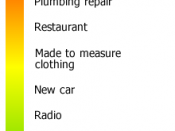

(Margetts)

To decrease negative consumption externalities, the government could increase the taxes or excise imposed on these goods or services. (Hall 1996) Increasing the taxes on these goods or services would cause the price to rise. This would then discourage the consumers from buying it or decrease the amount which they would or could buy. With the increase in taxes, there would be more revenue for the government to spend on. However, this might affect other consumers and certain firms in the industry. For example, if there was an increase of taxes imposed on alcohol, it would affect the wine industry and lessen their revenue. It would also affect the people who drinks only moderately and who had not caused any problems to the society. Increasing taxes on the goods does not necessary mean that people...