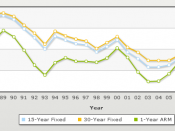

Our team is pleased to provide this paper discussing the California housing market and its apparent lack of affordability for the average wage earner. With the research and statistics behind us, we will now focus on the analysis of the data and will provide the reader with some recommendations for dealing with this economics problem. In review, the Team researched housing prices, household incomes, and mortgage interest rates. Each of the three factors has a significant influence over the affordability of owning a home in California.

Housing prices

Based on our research over a ten-year period, housing in California has spanned from a low of $178,160 to an all time high of $525,000. A range of $347,730 over the research period equals an increase of 196%. The average over the years was $346,841 which is in line with the actual median price of $343,825. This indicates a steady increase over the years.

Certainly there are homes that cost much more and much less than the median reported home price, however, our data looked at California as a whole and did not regionalize the information.

Household income.

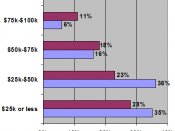

During the same ten year research period, the average California household earned as little as $37,009 and as much as $51,190. These are average household incomes as reported by the Census Bureau. Although there are households that earn much less and much more, our research was focused on statistical averages. Household incomes reported a narrow range of growth, compared to the housing prices. Over the research period, incomes spanned $14,181, reporting a ten year growth of only 38.3%, if home prices where to stop at this point, income would have to double to match the affordability; a significant variance from the home price growth of 196% for the same period. Based on the...