Introduction

El Café, an extremely popular coffee shop in Nicollett Mall, Minneapolis, Minnesota is going through a period of many challenges. The intent of this paper is to identify the scenario(s), explain recommended solutions and summarize the different capital structure concepts addressed in the simulation by answering the two questions: why is WACC important to an organization and what impact does WACC have on capital budgeting and structure?

The Scenario and the Recommended Solution

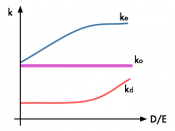

Scenario One: El Café is challenged to raise adequate financing for two additional shops. The objective was to select a debt-equity mix that minimized the WACC. The recommended solution is to obtain a debt-equity mix of 70 - 30% which achieved the lowest possible WACC of 8.65%.

Scenario Two: After four good years, El Café has decided to expand into other cities to accelerate growth and become a major player in the business. The objective was to select the optimal expansion strategy for El Café by benchmarking the projected rate of return against the WACC.

The recommended solution is to choose a 7 city expansion strategy with a debt-equity mix of 96.47% - 3.53% which provides a projected rate of return which is substantially higher than the WACC.

Scenario Three: El Café is experiencing hard times where the large amount of debt is the capital structure of which is leading to bankruptcy. The objective was to avoid the threat of bankruptcy. The recommendation is to swap 25% of the debt with equity and sell the real estate assets of which will provide a substantial amount of money.

Why is WACC Important to an Organization?

The weighted-average cost of capital is the rate of return that the company must expect to earn on its average-risk investments to provide a fair expected return to all its security holders.