Development Economics: Nature and sources of economic growth

Growth as an expansion of national productive capacity

"ûeconomic growth: increasing ability of nation to satisfy material wants of its people over period of time.

*Economic growth involves expansion of national productive capacity.

"ûProduction possibilities curve: representation of nation's productive capacity at given point in time.

1.All resources fully employed, fixed in supply, and easily transferable

2.technology is constant

3.only two goods are produced.

AB = Potential growth

capital B AC = Actual growth

goods C

A

O Consumer goods

*Potential economic growth: achieved as a result of an increase in national productive capacity - LDCs

*Actual economic growth: rate at which volume of real G&S is expanding over time - advanced nations

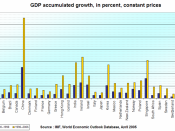

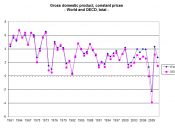

Measurement of economic growth:

*problems of measurement

"ûGross Domestic Product: total market value of final G&S produced in economy in any one year.

*Main limitations:

1.Does not include imports - a large source of economic growth - capital importation

2.Non-monetary incomes - GDP only measures value of G&S which enter into exchange

3.depreciation - net addition of production gives a more realistic account.

4.population changes - population may rise faster than production, with living standards falling.

5.income distribution - real GDP per capita cannot even measure where living standards improving

6.composition of output - No indication of division between capital & consumer goods

7.changes in productivity - do not take into account working conditions under which GDP rose.

8.the costs of growth - GDP cannot measure satisfaction in the community, lost/gained leisure

9.transfer payments - GDP only registers household incomes received for contribution to production

10.Underground economy - payments in cash in particular may go unrecorded - important in LDCs.

11.Non-material factors - political freedom, environment, cultural achievement not accounted for.

12.changes in the value of money - allowance must be made for inflation

*GDP at current prices (nominal GDP): annual output in terms of actual prices at which G&S sold.

"ûGDP at constant prices (real GDP): measures real value of goods and services produced in any particular year by eliminating the effects of inflation from GDP at current prices. (12.)

"ûReal GDP per capita: value of real G&S available to each member of population on average.

*accounts for population growth. (4.); allows for comparison between countries

*Real GDP per capita figures are the most widely used measure of a nation's standard of living.

*Standard of living: general level of material well-being of a nation's people.

*While real GDP per capita appears flawed as indictor of growth, it is the best measure available.

*alternative indicators

1.Proportion of GDP applied to capital: Measure of output devoted to capital (6.)

2.Real GDP per capita adjusted for the terms of trade: takes into account imports & trade. (1.)

3.Real productivity growth: indicates rate of increase in volume of G&S per person in labour force(7.).

4.Real per capita consumption expenditure: quantity of consumer G&S purchased by households. (8.)

5.Measure of Economic Welfare: externalities: leisure & pollution and environmental damage (8. 11.)

6.Physical Quality of Life Index: according to life expectancy, infant mortality & literacy. (11.)

Sources of growth: forces which promote the national expansion of real GDP per capita

"ûClassical theories of economic growth

*Adam Smith Inquiry into the Nature and Causes of the Wealth of Nations (1776):

*advocated division of labour, specialisation (absolute advantage) & accumulation of capital

*Advocated Laissez Faire - minimum government interference

*Emphasised importance of a stable legal framework, within the market could function.

*David Ricardo: formalised notion of diminishing returns, but did not take innovation into account

*Capital accumulation - increasing the stock of capital goods to expand productive capacity

"ûNet investment and the need for saving - capital accumulation requires net investment

*In consumer-oriented economy, saving is an exchange between present & future consumption.

"ûQuantity of capital goods - capital widening and capital deepening

*capital-labour ratio: relationship between nation's stock of capital and the size of its workforce

*Capital widening: capital stock rising at rate which keeps pace with labour force growth.

*Capital deepening: capital stock grows faster than labour force. Considered more important.

"ûQuality of capital goods - improvements due to R&D & innovation

"ûModels of Capital Accumulation

*Modern economic growth theory - founded in 1950s by Robert Solow and Trevor Swan

*Combination of capital deepening & technological improvement explains major trends.

*Assumptions:

1.perfect competition

2.economy in which output is produced by two inputs, capital and labour.

3.non-economic variables: Population and labour.

4.Major economic variables: capital stock and state of technical knowledge.

5.Amount of capital determined by the amount of net investment that occurs from year to year.

(a) Return on Capital(b) Factor-Price Frontier

%DD1%ff1

Rate of return Aa

on capital

BB1bb1

Ee

S

K / Lwages

*Without invention

a)Adding more capital goods to a fixed amount of labour will lead to diminishing returns to capital.

*Capital accumulation drives the rate of return on capital down from A to B to E.

*Eventually, the interest rate may be so low (on S) that no further capital accumulation takes place.

*If there is no technical improvement, output growth will be slower than capital growth

b)Because each worker works with more capital, marginal product rises leading to higher real wage.

*Capital accumulation drives up wages at the same time that rate of return on capital is beaten down.

*invention

"ûWith Invention - technological progress

*Inventions increase capital's productivity & amount of output paid to factors of production.

*Hence the productivity of capital moves from D to D1, & factor-price frontier moves from f to f1.

*These rightward shifts allow higher wages, productivity and output over time.

*Technological progress is not explained by the model - "exogenous" - arises outside the model.

"ûSchumpeterian innovation - an explanation of technological progress

*Schumpeter emphasised the role of the innovator - the dynamic actors of capitalism

*Innovation is periodically shifting the D curve upward and downward.

*Thus profits arise because of constant birth of new products and new markets.

*The innovation induced rise in interest rates will soon coax out saving and capital formation, until the accumulation of the augmented capital stock leads to diminishing returns and minimal interest

"ûEmpirical evidence - Growth Accounting Approach - quantitative techniques, to determine that "residual" sources outweigh capital deepening in the impact on GDP growth or labour productivity.

*Robert Solow, John Kendrick & Edward Denison, began to dig out sources of economic growth.

*Edward Denison analysed the sources of growth over the 1948-1981 period in the US.

*About one-third of growth in output can be accounted for by the growth in labour and capital.

*2/3rds residual attributed to education, innovation, economies of scale, scientific advancement.

"ûTechnological change and other resources

*raises productivity by increasing quantity and quality of all those resources to which it is applied.

*Land: Promotes discovery, development and use of new material resources.

*Labour: Leads to development of new skills - goes hand in hand with increases in human capital

*Capital: net effect of technological improvements in capital goods is to raise labour productivity.

"ûDeterminants of technological change:

*scientific capability - level of investment in human capital - quality of education system.

*governments involvement in R&D & large commodity markets increasing incentive.

"ûBias of invention: Majority have been labour saving rather than capital-saving since Ind. Rev.

"ûThe road from imitation to innovation

*Chui, Levine, Pearlman & Sentance: 'Innovation, Imitation and Growth in a changing world economy' - creation of knowledge spreads its benefits across borders.

*Increased innovation in Asia should raise living standards in rich countries by expanding both the range of G&S that consumers can buy and the inputs that firms can use.

*R&D also spending yields a public return - 'externality' of improved general knowledge.

"ûNew Growth Theory: Seeking to make technological progress endogenous.

*A firm will not innovate unless it thinks it can steal a march on its competition & earn higher profits.

*Inconsistent with Neo-Classical assumption of perfect competition - no "abnormal profits".

*Attention shifted to conditions under which a firm will innovate most productively:

*how much protection should intellectual property law give to an innovator?

*labour resources and human capital

"ûSize of labour force - Increase in population can stimulate growth by expanding domestic market.

*Population control - an effective way to raise real GDP per capita.

"ûThe quality of the labour force - human capital - conducive to high productivity & real output

*East Asia's success: early 1960s, well-educated workforces & low physical capital.

"ûEntrepreneurial ability - organises and combines other resources to make a profit.

*The quantity of entrepreneurs - forces which encourage entrepreneurial talent include:

*A well-developed capital market, infrastructure & favourable social & political climate

*Quality of entrepreneurs improved by increasing education & government assistance to business.

"ûHarrod-Domar Growth Models - links labour, capital and technology growth

*Natural Rate of Growth: % growth per year of labour supply expressed in "efficiency units" (natural labour units as augmented by increase in technical effectiveness of each person per hour);

*Output & capital must be growing at the same natural rate.

*Savings/GDP ratio depends on numerical value of capital-output ratio times natural growth rate:

s = g . K

Q

*Harrod-Domar growth model explains five trends of economic development:

1.Population has grown, but at a slower rate than capital stock, allowing for capital deepening

*K must grow at Labour force growth + labour augmenting effect of technological change

2.There has been a strong upward trend in real wage rates

*workers collect marginal product of increasing efficiency units

3.capital-output ratio has declined over the century - diminishing returns not invoked.

*Each unit of K matched by labour augmentation & labour force growth - no fall in interest rate.

4.The ratio of national saving to total national output has been stable over long periods of time

*constancy of the saving-income ratio is verified by the basic Harrod formula: s = g . K/Q

5.GDP has grown at a high steady rate over the century: Large residual

*Neo-Classical analysis provides growth that equals capital, output & 'efficiency units' growth.

*Degree of government participation in the economy

"ûNew growth theory - a new school of the 1980s which focuses upon government involvement

*Questions law of diminishing returns in neo-classical model - Paul Romer:

*Endogenous growth theory says that government policy to increase capital or foster right kinds of investment in physical capital can permanently raise economic growth.

*if capital broadened to include human capital, law of diminishing returns may not apply - increasing returns to investment from education & efficiency - innovation not necessary.

"ûExtent of capacity usage - government encouragement of open markets

*Mancur Olson, 1996, problem is not lack of resources, but inability to use existing resources well

"ûEmpirical evidence: Measuring effect of government policy on economic growth

*Edward Denison investigated the potential of steps to speed growth - results were startling small.

*increase national savings & investment rate: most obvious way to grow more rapidly.

*Ambitious programme might raise net investment by 2% of GDP, leading to a minute 0.1% increase in annual growth rate over following decade.

"ûMost empirical evidence points to the primacy of government choices

*free-market policies: trade liberalisation & secure property rights raise growth rates.

*Jeffrey Sachs & Andrew Warner, 1995, divided 111 countries into "open" & "closed".

*The "open" economies showed strikingly faster growth than the "closed" ones.

*Smaller government helps: Robert Barro - higher government spending leads to slower growth.

"ûSupport for Neo-Classical Model & New Growth Theory models through study of East-Asian tigers

*Alwyn Young, 1994, Asian tiger's success resulted from:

*NCM: rapid accumulation of capital (through high investment)

*NCM: labour (through population growth and increased labour-force participation)

*NGT: Government policies of encouraging education, opening economy to foreign technologies, promoting trade, keeping taxes low & encouraging savings (30% of GDP in 'tiger' economies)

*a small state - government spending around 20% of GDP compared to over 50% in Europe

"ûMeasuring the impact of political factors in novel ways.

*Stephen Knack & Philip Keefer - 'Institutions and economic performance'

*International Country risk guide to construct index of political stability for a businessman

*They found a strong correlation between the index and economic growth.

*Silvio Borner, Aymo Brunetti and Beatrice Weder in 'Political Credibility and Economic Development': asked entrepreneurs in 28 developing countries on reliability of government.

*index of 'political credibility' correlated with growth, able to explain 50% of variance in per capita growth in the countries sampled between 1981 and 1990.

"ûGovernments should open stockmarkets to foreign investors to increase liquidity

*Ross Levine & Ms Zervos: market liquidity closely related to economic growth

*Had Mexico's stockmarket been as liquid as Malaysia's in 1976, its economy would have enjoyed 0.4% a year faster growth per capita until 1993.

*Development and expansion of new and existing markets

"ûIncreasing participation in international trade: specialisation, economies of scale

*Resources & technology can be imported - provides capital in particular for Australia and LDCs.

One question.

Are these supposed to be study notes? or are they just a list of facts?

0 out of 0 people found this comment useful.