INVESTMENT APPRAISAL

Characteristically, a decision to invest in a capital project involves a largely irreversible commitment of resources that is generally subject to a significant degree of risk. Such decisions have far-reaching effects on a company's profitability and flexibility over the long term, thus requiring that they be part of a carefully developed strategy that is based on reliable appraisal and forecasting procedures.

In order to handle these decisions, firms have to make an assessment of the size of the outflows and inflows of funds, the life span of the investment, the degree of risk attached and the cost of obtaining funds.

One of the most important steps in the capital budgeting cycle is working out if the benefits of investing large capital sums outweigh the costs of these investments. The range of methods that business organisations use can be categorised in one of two ways: traditional and discounted cash flow techniques.

Traditional methods include the Average Rate of Return and Payback; discounted cash flow (DCF) methods using Net Present Value and Internal Rate of Return.

NET PRESENT VALUE (NPV)

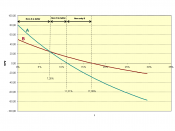

Net present value is a way of comparing the value of money now with the value of money in the future. A euro today is worth more than a euro in the future, because inflation erodes the buying power of the future money, while money available today can be invested and so grow.

The technique is a three-stage process:

to calculate the present value of each element of cash expenditure in a proposal and then, to add these individual present values together to provide a total present value of the expenditures;

to similarly calculate the present value of each element of cash income in a proposal and, then, to add these individual present values together to provide a total present...