1.Calculate Dunham's 1995 financial rations. (See Exhibits 1,2, and 3).

Current Ratio = (current assets/current liabilities) = (16,268/7,600) = 2.1405%

Inventory Turnover = (sales/inventory) = (26,671/6,133) = 4.3487%

receivable____ = 5,920___ = 81.01 Days

DSO = annual sales/365 26,671/365

Fixed Asset Turnover = (sales/net fixed assets) = (26,671/3,336) = 7.9949%

Total Turnover Asset = (sales/total assets) = (26,671/16,268) = 1.6394%

Total Debt to Total Assets = (total debt/total assets) = (9,666/16,268) = 0.5941%

Time Interest Earned = (earnings before interest taxes/interest charge)

= (1,331/578)

= 2.3027%

EBITDA Coverage = (EBITDA + Lease Payment)/( Interest + Principal payment + Lease Payment)

Profit margin on sales = (net income available to common stock)/(sales)

= (376/ 26,671)

= 0.01409%

Basic Earning Power = (EBIT/ Total Assets) = (753/16,268) = 0.0462%

Return on Total Assets = (Net income available to common stock/Total Assets)

= (376/16,268)

= 0.02311%

Return on common equity = (Net income available to common stockholders/Common Equity)

= (376/6,602)

= 0.05695%

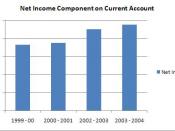

2.Does a trend analysis indicate Dunham's position has been deteriorating? (See Exhibit 3)

A trend analysis indicates that Dunham's position has been deteriorating.

3.Is the bank justifiably concerned? Justify your answer.

The bank is justifiably concerned because the debt ratio increases and creditors prefer low debt rates due to the reason that the greater cushion against creditor losses in the event of liquidation.

4.Nineteen ninety-four was a "down" year for Dunham. Do you think that CBG had a responsibility to express concern in 1994, especially since the current ratio was close to 1.85, the number that could trigger a call of the loan? Explain.

GCB had the responsibility to express concern in 1994, especially since the current ratio was close to 1.85. The current ratio is calculated dividing current assets by current liabilities. Current assets normally include...