Economic Survey: United States 2004: Ensuring fiscal sustainability and budgetary discipline

I. SUMMARY:

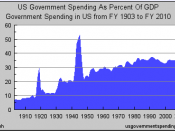

The federal budget has moved from a surplus of nearly 1ý per cent of GDP in fiscal year 2001 to a deficit of 3ý per cent in 2003 and a projected 4ü to 4ý percent in 2004. This rapid decline is attributable to sharply reduced tax receipts following the recession and the demise of the stock market bubble combined with tax cuts and the rapid expansion of defense, "homeland security" and other discretionary outlays. While the cyclical drag on public finances should fade soon, recent policy changes on both the revenue and outlay sides imply that, under realistic assumptions and absent corrective action, the deficit will remain substantial over the next ten years by both US historical and international standards. At that time, the retirement of the baby boom generation will be in full swing, putting enormous pressure on entitlement programmers.

Now that the recovery has taken hold, measures to reduce the deficit are urgently needed if the beneficial effects on long run national income from recent marginal tax rate cuts are not to be outweighed by the adverse consequences of the fall in public and national saving. These measures should aim both at curbing outlays and, to the extent revenues have to be raised, broadening the tax base. In its 2005, Budget the Administration proposes to halve the deficit by 2009 through unprecedented restraint on non-security expenditure. However, even if that objective were achieved, it might nonetheless not be ambitious enough in view of the Administration's intention to make the recent tax cuts permanent, its defense aspirations, the need to deal with the surging numbers of taxpayers who will be subject to the Alternative Minimum Tax and the serious demographic effects on entitlement spending that would...