Scenario

Examine the following document:

Revenues: $1,000,000

Operating Expenses:

- Cost of goods sold: $400,000

- Depreciation: $100,000

- Salaries and wages: $200,000

Bond interest (8% debentures sold at a maturity value of $1,000,000 $80,000

Dividends declared on 6% preferred stock (par value $500,000) $30,000

Dividends declared of $5 per share on common stock (20,000 shares outstanding) $100,000

Based on this information you are to complete the following tasks:

1. Determine the income under each of the following equity theories:

- Proprietary theory

- Entity theory (orthodox view)

- Entity theory (unorthodox view)

- Residual theory

2. Would any of your answers change if the preferred stock is convertible at any time at the ratio of 2 preferred shares for 1 share of common stock?

Please submit your assignment.

Proprietary Theory

According to the VentureLine Glossary "PROPRIETARY THEORY is where no fundamental distinction is drawn between a legal entity and its owners, i.e.

the entity does not exist separately from the owners for accounting purposes. The primary focus is to report information useful to the owners, and therefore the financial statements are prepared from their perspective" (VentureLine, 2005b). The owner and the firm are virtually identical (Wolk, Dodd, & Tearney, 2004, p. 143). Equity costs such as dividends are not considered expenses, while debt costs are.

Assets - Liabilities = Owner's Equity (Wolk et al., 2004, p. 143)

In our example this would result in the following income:

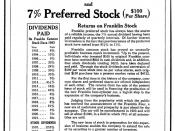

Exhibit 1

Debt costs such as the bond interest are included when calculation net income, while equity costs such as dividends are not.

Entity Theory

According to the VentureLine Glossary "ENTITY THEORY is where a legal entity is regarded as having a separate existence from the owners. The financial statements are prepared from the perspective of the entity, not its owners" (VentureLine,