With today's market becoming increasingly deregulated, privatised and capitalist, the government has seen a dramatic loss of economic control in recent years. Monetary Policy is one of the government's strongest influential tools of the modern economy so that if it may promote:

÷Stability of the Australian currency

÷Full employment

÷Economic prosperity

It is the duty of the Reserve Bank of Australia (RBA) to use Monetary Policy to best achieve these goals for the government. The Business cycle is a continual cyclic fluctuation of boom and bust which echoes throughout the economy. Monetary Policy alters the money market, the core of the business cycle, in order reduce the extremities of the cycle and produce slow sustainable economic growth.

The RBA is able to alter the money market by influencing interest rates throughout the economy. This is done through a complex system in Domestic Market Operations (DMO). Banks are require to have a certain proportion of their funds held by the RBA in exchange settlement accounts.

This is because every day there is a large amount of funds transferred between banks in everyday market operations, at the end of each day these amounts are tallied up and cancelled out. Sometimes banks are left with an overnight deficit and require an overnight loan to cover this.

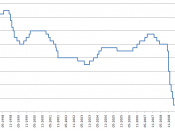

The RBA, however, affects these short-term money markets by changing the cash rate. This is done by either buying or selling second-hand government securities to the FI's it deals with. By buying or selling these government securities the RBA increases or decreases the supply of funds within the short term money market and as demand is constant this will effectively alter the cash rate.

This may be clarified in the following 2 scenarios:

1.-The RBA sells government securities in the short term money market to FI's

-The RBA gains funds from selling these securities and equally the short term money market loses these funds through purchasing securities.

-Less money in the money market = Less Supply

-Less supply= Increased cash rate

2.-The RBA buys government securites in the short term money market from FI's

-The RBA loses funds by purchasing these securities and equally the short term money market gains these funds by selling these securities.

-More money in the money market = More Supply

-More Supply= Lower cash rate

As Financial Institutions are the main source of all loans the cast rate shall echo through onto the economy to enable the RBA to effect the economy as a whole.

A tightening of Monetary Policy is an upward pressure on interest rates caused by the RBA reducing the Supply of funds within the short term money market (scenario 1). As interest rates rise the economy will follow trends of reduced consumer spending due to increased cost of mortgages and loans and lower business investment this will domino through the many areas of the economy (unemployment, welfare, etc) and overall lower economic activity.

An easing of Monetary Policy is downward pressure on interest rates caused by the RBA increasing the Supply of funds within the short-term money market (scenario 2). With lower interest rate consumers will be more willing to spend money and businesses will more readily invest. Aggregate demand shall rise and economic activity will increase.

The main reason interest rates affect economies to such a degree is our dependence on credit. Increased interest rates make transactions increasingly expensive and therefore deter both investment and spending.

As this is such a powerful tool there are many factors the RBA must consider before altering Monetary Policy:

÷Interest Rates- Increased cash rate cost the bank more to operate and there fore these expenses funnel in to the interest rate, making it more expensive for consumers to obtain a loan.

÷Economic Growth

÷The inflation rate

÷Inflationary expectations

÷Wages growth

÷Unemployment

÷Exchange Rates

÷Several measures of Monetary growth

-Money base- currency pus all funds held by RBA deposited by private sector

-M3- currency, + all bank deposits

-Broad Money- currency + all deposits + all NBFI deposits

-The credit aggregate- all lending by FI in private sector

Although the RBA always acts to befit Australia it must look at the broad spectrum of the economy and it's performance. As Monetary Policy is such a powerful tool and affects so many sectors, while encouraging one area of the economy to develop it may discern another. The RBA is required to check how their Policies will affect these areas in the short to medium term as well as their long term goals.

÷Lower interest rates - effectively cheaper for businesses and consumers to spend and invest.

-Leads to ^ consumption, ^investment Demand, ^spending and ^ economic activity

÷Lower interest rates- reduces cost of maintaining existing debt and could increase debt.

÷Lower interest rates- reduce financial inflow into Australia. Depreciate currency.

-V interest rates, ^ aggregate demand, ^ economic activity and ^ inflation.

÷Lower Interest rates- increase aggregate demand

-^ output, ^ employment, ^ prices, ^ wages if full employment

÷Lower interest rates- increased aggregate demand

-^ demand for money, RBA raising supply of money

A change in the cash rate may influence these by:

÷Economic Growth-As it is more expensive to obtain a loan people from increased cash rates are less willing to spend a businesses are less willing to invest, this leads to lower aggregate Demand and decreased Economic growth.

÷A lower cash rate lowers interest rates increases ec activity and agg D this increases inflation as there will be reduced financial inflow to Australia.Inflation and inflation expectations- low inflation of about 2-3% will achieve long term Eco growth.

÷Wages Growth- If lower interest increases ag Demand in an economy where the is close to full employment there will be insufficient labour to cater for demand leading to wages growth.

÷Unemployment- By increasing the cash rate this lowers ag D and lowers production causing higher unemployment.

÷Exchange Rate-As a higher cash rate will ^ interest rates and decrease agg D and eco activity people will be less willing to trade causing a fall in exchange rates

The Governor and the Treasurer agreed that the appropriate target for monetary policy is to achieve an inflation rate of 2-3 per cent on average, over the cycle, a rate sufficiently low that it does not materially distort economic decisions in the community. The inflation target is thus the centrepiece of the monetary policy framework. It provides discipline for monetary policy decision-making, and serves as an anchor for private sector inflation expectations.

The current situation, in summary, suggests an outlook that is consistent with the medium-term inflation target but subject to two broad sources of risk - the potential for further weakness arising from external factors, and the destabilising influence of a growing imbalance in the domestic credit market. These two factors have conflicting implications for monetary policy, since lower interest rates would help to offset the first of these risks but would amplify the second. In its policy deliberations the Board has had to take into account the balance of these risks and the way they have evolved over time.

The current assessment of the economic outlook, the case for an easing was judged to have weakened since June, and thus the cash rate was again kept unchanged at both the July and August meetings.

Social Sciences

As a major in economics, this paper is research intensive and a good source of information. A clear and accurate portrayal, in simple language, of the overall effects of Monetary Policy.

On a technical note to the author...could use a little better coherence, but very strong unity and coherence.

3 out of 3 people found this comment useful.