MANAGING FINANCIAL RESOURCES

Assignment on

Managing Financial Resources

Submitted by:

YESHWANTH RAJ P

MBA - Executive Stream (Full-time)

November 2006

No. of words: 1998

�

SYNOPSIS

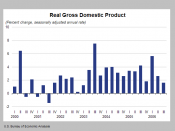

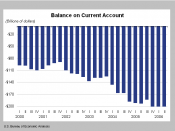

This Paper considers the factors that have driven the U.S Federal Reserve's manipulation of interest rates via the Federal Funds Rate. A change in interest rate affects the investment, consumption, government expenditure, exports and imports level in the economy. Along with it, it is seen as a tool for curing unemployment level and curbing inflationary pressures. As such, it analyses the impact of the change in interest rate on the economy and national income of the USA.

The layout of the Paper is as below:

The Federal Reserve System and the Maestro

The bygone Decade: Actions taken by the US Federal Reserve

The Reasoning: factors and conditions

The Opinion / The Comment

Appendix 1

Bibliography

�

The Federal Reserve System and the Maestro

The Federal Reserve System is the Central Bank of the United States of America.

It is popularly known us the 'The Federal Reserve' or simply, 'The Fed'. One of its responsibility and duty is:

"Conducting the nation's monetary policy by influencing money and credit conditions in the economy in pursuit of full employment and stable prices"

(Federal Reserve)

The Fed achieves this objective through The Federal Open Markets Committee (FOMC), which oversees the open market operations. Ben S Bernanke has been recently appointed as the Chairman of the Board of Governors.

Allan Greenspan was the Chairman from August 1987 to January 2006. He is credited with 'taming' the inflation, maintaining low unemployment rate and managing the crisis in the US Economy effectively. He is widely called as 'the Maestro' for his ability to rein the inflation and fuel the economic growth with conservative monetary policies. Nevertheless, the US Economy is today...