In this essay I would like to discuss why the Fed changes interest rates, what economic mechanism uses interest rates to affect the economy, if the Fed's announcements really make a difference, and what the Fed's most affective monetary policy is.

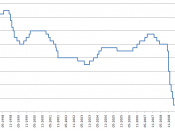

The first question to be answered is why does the Fed change interest rates. The Fed cannot control inflation or influence employment directly so instead, it affects them indirectly, by raising or lowering interest rates. Interest rates play an important role in the general business cycle and financial markets. When rates rise, consumers spend less, corporate profits are reduced, the stock market declines, and unemployment goes up. The Fed uses monetary policy as the economic policy to change interest rates and try to regulate consumer spending, the stock market, and unemployment.

Do the Fed's announcements really make a difference? Yes, when the Fed makes an announcement it has an effect on people.

When the interest rates go up, consumers will buy less and when rates go down consumers will usually buy more. When rates go up it is usually good news, and people will go get new mortgages on their houses, or maybe even buy a new house or car thus helping the economy.

In conclusion the Fed's only way to control inflation or influence employment is by affecting them indirectly with monetary policy by raising or lowering of interest rates. The federal-funds rate is the main monetary policy instrument of the Fed and it does not directly impact the economy but when the news of lower or higher interest rates is spread, consumers react and therefore the economy reacts to their changed spending habits.