Federal Reserve System is an independent agency of the United States government that helps oversee the nation's banking system. The Federal Reserve System is known as the central bank of the United States. Its most important job is to assist the U.S. government in managing the economy by encouraging economic growth and controlling inflation. It pursues these goals by influencing interest rates and, the availability of money and loans. The program the Fed follows in influencing interest rates is called its monetary policy. The Fed also performs many financial services for the federal government and provides numerous services to commercial banks.

History: Congress established the Fed in 1913 to provide a flexible currency for the nation and to strengthen the supervision of the banking system. By the mid-1930's, Congress gave the Fed authority to set reserve and margin requirements.

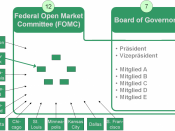

Organization.

The Fed has 12 Federal Reserve Banks and 25 Federal Reserve Bank branches.

Each Federal Reserve Bank (FRB) operates in one of the country's 12 Federal Reserve districts. Most districts have from one to five FRB branches, each of which offers many of the services that FRB's provide. Banks in the FRS use their FRB much as people use a bank in their community.

All national commercial banks are required by law to be members of the Fed. Membership is optional for state-chartered banks. But all deposit-taking institutions are subject to Fed requirements regarding a certain amount of deposits that cannot be used for loans.

Two main committees direct Fed policies. They are the Board of Governors and the Federal Open Market Committee. The Board of Governors administers the system. It has seven members. Each member is appointed by the President of the United States to a 14-year term, subject to the consent of the U.S. Senate. The President...