INVESTMENT DESCISIONS 3

FINANCING YOUR INVESTMENT 3-4

WHY BOTHER? 4

WHEN? 4

RISKS? 4

TYPES OF INVESTMENTS 5-6

BUGETING 7

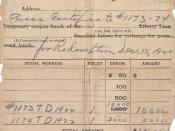

RECORD KEEPING 8

BECOMING FINACIALLY RESPONSIBLE 9

FINACIAL MANAGEMENT 10

WHERE TO GO 11

INVESTMENT DECSICIONS

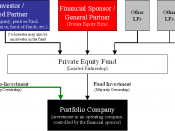

Investing means putting your money away to work for you so as to gain a profitable return. This means that while you are sleeping or working your money is working for you to make you more money to save, spend or reinvest. There are many "Investment Vehicles" that you can entrust to carry your money these include stocks, real estate, bonds and mutual funds. No matter what method you choose the goal is to put your money to work for an additional profit.

Investing is not gambling as you are putting your money at risk with no certain outcome, true investing does not happen without some effort on your part.

There are two main categories for investments:

GROWTH ASSETS:

Such as shares and property which provide a higher return over longer time periods.

Although these types of investments are unpredictable as their prices rise and fall in the short-term so they are of a higher risk.

INCOME ASSETS:

Such as government bonds and term deposits, which give you a lower return but offer a lower risk investment, as their prices are not change drastically in the short-term.

So you may conclude that the higher you return is the higher the risk that is involved in your investment.

FINANCING YOUR INVESTMENT

There are two main ways for financing your investment decisions either through saving or borrowing money, most people save for small investments and borrow for large ones. Before you invest you should first look at your financial position so as not to commit money that you cannot afford to be without.

SAVING:

The advantage...