Accounting records the dual effect of double-entity bookkeeping. Each transaction affects at least two accounts - one on accounts debit and other on credit side. This assures, that the accounting equation (Assets = Liabilities) balances after each transaction. Transactions are first recorded in the journal and after that posted to the accounts in the general ledger. Accounts are classified as permanent accounts and temporary accounts. The temporary accounts are revenue and expense accounts and they relate to particular accounting period and are closed at the end of the period. At the end of one period business transactions are reflected on the permanent accounts balance of an account. Balance and also income statement are compiled based on accrual-basis accounting and therefore must be corrected at the end of the period.

Despite of strict accounting rules, financial accounting gives opportunities to vary. Different methods are used in inventory and depreciation costing methods.

For instance, double-declining balance depreciation method allows to show more expenses and less profit than straight-line method.

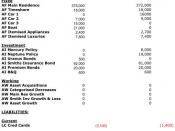

Because the income depends on different Costing Methods and accrued expenses and revenues, in many countries the organizations are engaged to disclose the cash flow statement which is cash-basis, shows cash inflows, outflows and net increase or decrease in cash during the accounting period. Cash flow statement gives information about changes in organizations financial situation and helps to evaluate firm's ability to dividends and intrests. In order to have a better overview on organizations financial situation firms are obligated to bring forth information about changes in financial situation in operating, investing and financing activities. The following example is part of a cash flow statements first part, which is compiled in indirect method:

Cash flow in operating activities.

Net income

Add:

Depreciation

Decrease of stocks

Increase in accounts payable

Loss on sale of financial...

Ridiculous.

This is a college essay, is it? What colleg gives students 80% for "Despite of strict accounting rules, financial accounting gives opportunities to vary." No organisation, structure, repeated grammar/vocab errors etc. Need I say more?

0 out of 6 people found this comment useful.