Recent Statistical Trends.

EU GDP Growth.

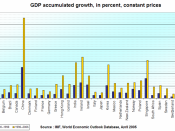

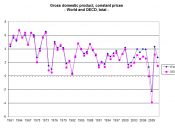

The EU economy saw a slowdown in growth to only 0.3% in the third quarter of 2004, with the year-on-year growth rate easing to 1.8% as a result (see Exhibit 1).

This reflected particular weakness in Germany and France in the third quarter, although growth held up better in Spain and Italy during that period.

Earlier oil price rises mean that headline EU inflation remains above 2%, but underlying core inflation is still consistent with the European Central Bank's revised target of keeping inflation "below but close to 2%" over the medium term. The European Central Bank therefore left official interest rates unchanged at 2% throughout 2004 and there is no indication that an early change in rates is planned.

A representative example is this of the UK economy, which grew strongly during the first half of 2004, but also suffered a deceleration in growth in the third quarter.

Growth has been supported by significant increases in public spending, although this has led to some concerns that tax rises will be needed in the medium term in order to reduce the budget deficit from its current level of around 3% of GDP. For the moment, inflation remains below target, despite the effect of oil price rises, and UK interest rates have been left on hold since August.

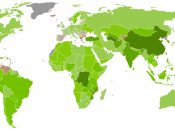

Elsewhere in Europe, growth recovered strongly in Sweden in 2004 and more gradually in Switzerland. The Polish, Czech and Hungarian economies all continue to record growth well above the EU average.

MANAGERIAL IMPLICATIONS - INVESTMENT DECISIONS

As a result of the slowdown mentioned in the beginning of the report, consumer spending and investment growth remains relatively subdued in EU, and export growth has slowed in the face of an appreciating euro and somewhat weaker growth...