In its broadest sense, the term "intermediary" includes any person who serves to bring other persons together. In the world of corporate finance, a financial intermediary is an institution that acts as a middleman between savers and borrowers. Specifically, these institutions accumulate money from investors and lend it to borrowers. A person with extra money could seek out borrowers alone and bypass intermediaries altogether (Schenk). By removing the middleman, the saver would most likely receive a higher return.

Financial intermediaries provide two important advantages to depositors. The first advantage is that lending through an intermediary is usually less risky than lending directly. The intermediary has the ability to diversify. Financial intermediaries make a considerable number of loans/transactions, and while a percentage of it will be unsound, the losses are largely balanced by the profitable. At Intel and AMD, intermediaries have the ability to put their stake holders "eggs" in many "baskets," thus ensuring minimal risk to its depositors/share/stock holders (Schenk).

Financial intermediaries are made up of many different financial institutions.

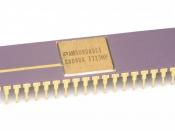

Financial regulatory bodies now cater Stock markets across the world to an ever-growing base of retail investors. Transaction amounts have become lower, and with a larger base of investors, trading hours need to be longer. Sophisticated financial products and savvy investors demand a leading-edge trading system that is capable of handling demands in terms of volume as well as sophistication. The demand for lower cost of trades and the growing popularity of new, innovative financial instruments, along with the rapid increase of cross-border and after-hours trading, Intel and AMD are high volume marketplace traders. Regulatory changes are also being implemented that allow for the setting up of new online marketplaces or the altering of traditional marketplaces to cater to these demands from investors. While the financial regulatory bodies stays...