TOPIC 3: The Flow of Funds and Determination of Interest Rates

Objective 1

Identify the main features of the role played by the different sectors of the economy in the flow of funds between surplus and deficit units.

3.1 The flow of funds

In Topic 1, one of the main functions of a nation's financial system that was identified was to facilitate the transfer of funds from surplus to deficit economic units, in primary financial markets, by the creation of new financial assets. That is to mobilise the savings of surplus economic units and transfer these funds, either directly or indirectly, to deficit units in order to finance their planned expenditure.

In examining the flow of funds there are two aspects that are of interest to financial market observers:

sectoral balances

institutional features

The latter aspect is concerned with the role played by different types of financial institutions in the flow of funds by means of indirect or intermediated finance.

As this was examined in Topic 2, this section will focus on the sectoral balances aspect of the flow of funds.

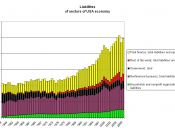

3.1.1 Sectoral balances

The domestic economy comprises three aggregate sectors:

households

corporations

government

When we expand our focus to the open economy, we add a fourth sector:

the rest of the world

Finally, when examining the financial system, we separate out a subset of the corporations sector, because of the special role that particular organisations play in the operation of the financial system, and create a fifth sector:

financial corporations

These five aggregate sectors can be examined in terms of their overall role and position concerning the borrowing and lending of funds within the financial system. Clearly, each sector will comprise a number of both surplus and deficit units but it is the net position of the aggregate sector...