Financial resources are those resources that have monetary value

Financial management is the planning and monitoring of an organizations financial resources to enable the organization to achieve its financial goals

Assets are the property and other items of the business both tangible and intangible.

Objectives of financial management:

Liquidity - ability to pay short-term debts.

Profitability - maximizing profits

Efficiency - ability to maximize profits with minimal resources

Growth - increase size in the longer term

Return on Owners Equity - percentage of profit compared with total invested.

The Planning Cycle

Address current financial position

Determine financial elements of business plan

Develop budgets

Monitor cash flow

Interpret financial reports

Maintain record system

Planning financial controls

Minimizing financial risk and losses

Major participants in financial markets

Banks

Finance/insurance companies

Merchant banks

RBA

Super funds

Mutual funds

Public/private companies

ASX

Sources of funds

Internal sources

- Owners equity

- Retained profits

Advantages

- Low gearing

- Less risk

Disadvantages

Lower profits and return on OE

External sources

o Short-term

ç Overdraft

ç Bridging finance

ç Bank bills

o Long-term

ç Bonds

ç Mortgage

ç Term loans

ç Leasing

ç Factoring

ç Trade credit

ç Venture capital

Advantages

Increased funds

Tax deduction on interest repayments

Disadvantages

Increased risk

Security required

Regular repayments

Lenders have first claim on money if they go bankrupt

Leverage measures the relationship between debt and equity

The accounting framework

Raw Data

Processed Data

Accounting Data

Analysis of report

Financial Statements

ç Revenue statement - shows revenue earned and expenses incurred over the accounting period.

ç Balance Sheet - shows the businesses assets and liabilities at a point in time.

Financial Ratios

Liquidity

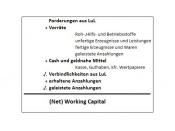

Current Ratio = Current assets

(working k) Current liabilities

2:1 safe position

Solvency

Debt to equity = Total liabilities

Owner's Equity

Profitability

Gross Profit = gross profit...