1.IntroductionWhat is the proper standard to assess a company's performance and financial position? Lots of answers could be given because of different measures. For example, reading an annual report, readers may find that the word "profit" has several meanings. "Measures of profitability," Philip O'Regan (2005) states in his book, "will be important for a variety of users". Since different user has different method to judge a company's "profitability", shareholder would choose return on shareholders' funds to make a decision whether invest a company or not; meanwhile, a bank would consider a company's return on capital employed before lending money. With significant accounting ratios, this paper assesses the profitability, liquidity, management of working capital and the capital structure of Metalrax Group plc and finally compares performance and financial position between two companies in the same industries.

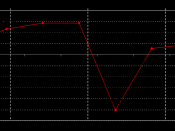

2. ProfitabilityFigure 2.1 apparently shows that although Metalrax does increase its sales revenue by 5.35%,

all the "profits" declines from 2004 to 2005. The relatively increase in sales revenue does not help the company increase the gross profit, because cost of sales have increased by 10.04% which is nearly twice larger than sales revenue. It primarily results in the decrease of profitability ratios. Return On Shareholders' Funds, Return On Capital Employed, Net Profit Margin and Gross Profit Margin.

Two factors may explain why cost of sales has increased so sharply. Increasing fix cost may induce to increase cost of sales. In 2005, Metalrax invests 3.7 million on fixed assets that tremendously increase cost per unit. Therefore, Metalrax should consider selling any fixed assets, which are excessive to the requirement of productivity. The second factor may be the growing variable cost per unit. Employees may request for increasing their wages because of the company's profitability in last year. Raw material price may rise as well.