PROJECT REPORT

ON

HOW TO OPEN A LETTER OF CREDIT

(From Importer & Exporter Perspective)

Submitted By:

Tanveer Ahmad

Roll No.1205161

MCOM (Finance) 3rd Semester

Submitted To:

Prof: Mumtaz

Date: 05/05/2013

EXECTIVE SUMMARY

I have an opportunity to make an assignment on letter of credit under the guide line of our teacher Sir Mumtaz.The objective and scope of the study was to gain exposure in the field of international business,to study verious methods of payments,to analyze the issues during documentary credit procedure and to come across how letter of credit is opened.

For this i have personaly interviews with Sonari Bank main branch karachi Assistant Manager Salman Lalani of the Trade department.He has provide me all the necessary information but he have not provide me the docoments which i required.

TABLE OF CONTEXTS

LETTER OF CREDIT INTRODUCTION 04

PARTIES INVOLVED IN LETTER OF CREDIT 05-06

TYPES OF LETTER OF CREDIT 06-07

STEPS BY STEPS PROCESS 07

INFORMATION THAT AN L/C MUST HAVE 08

CONFIRMATION OF L/C 08

DOCUMENTS THAT MAY BE STIPULATED IN AN L/C 09

COMMON DEFECTS IN DOCUMENTATION 10

TIPS TO MINIMIZE RISKS 11

SUMMARY 12

Letter Of Credit (L/C)

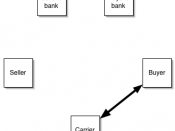

A letter of credit (L/C) is a bank's promise to pay the exporter all the agreed value of the

consignment on behalf of the foreign importer, provided that the exporter has complied

with all the terms and conditions of the L/C.

L/C is the most used payment term in International trading and equally a perfect

procedure to protect the interests of an exporter as well as importer. Using L/C as a term

of payment, the risk of the parties comes almost to nothing and at the same time it

ensures the buyer that goods are shipped before the payment is actually made and the

seller that...