Every business needs to keep record of cash that comes into the business, goes out, services are rendered on credit and money invested, just to name a few events. The method used to record or track all these events is called Accounting. Merriam Webster defines Accounting as, "the system of recording and summarizing business and financial transactions and analyzing, verifying, and reporting the results". (www.m-w.com) The text defines Accounting as, "information system that identifies, records, and communicates economic events in an organization". (Kimmel, 2005) Accounting is needed in order to collect and record the economic events within a company to continuously evaluate the company's financial status. There are four financial statements that summarize the accounting data recorded. These four statements are the Income statement, Retained Earnings statement, Balance Sheet, and the Statement of Cash Flow.

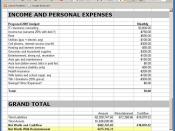

The Income statement, also known as the Profit and Loss statement, represent the revenues the company has generated, expenses it has accrued over a specified period of time.

The results produce the company's net income or net loss for that time. The specified period of time when this report is prepared can be at the end of month, end of quarter or end of year. The report is basically a physical representation of the company's financial success or of its losses. In this statement revenues are listed first, followed by expenses and then the net income or net loss is calculated.

This statement is important to investors, managers, company officers and owners because the results show how well the company is doing or how much the company is losing. By analyzing this report investor can decide whether to invest more or less in the company, and managers, company officers, and owners can decide what action to take to continue the company's success. All four...