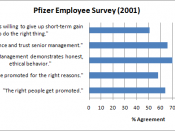

Ratios can be calculated from the information shown on a company's financial statements. The trends shown over several periods can be used to make inferences about a company's finances, and operating efficiency. Financial ratios are not only used to make comparisons within a company, but also against other businesses in the same industry. This report will focus on the financial ratios of Pfizer Inc.

Pfizer Inc. discovers, develops, manufactures, and markets leading prescription medicines for humans and animals and many of the world's best-known consumer brands (Pfizer, 2005). Pfizer is the manufacturer of prescription drugs such as Clebrex, Lipitor, Viagra, and Zoloft.

Financial Ratios for Pfizer, Inc. from Mergent Online

2004 2003 2002

Profitability Ratios

Return on Equity % 16.6 2.51 46.02

Return on Assets % 9.16 1.4 19.81

Return on Investment 181.71 90.51 344.33

Gross Margin .086 .078 .088

Operating Margin % 28.11 15.21 36.07

Net Profit Margin 26.67

7.22 36.07

Liquidity Ratios

Quick Ratio 1.13 .89 1.01

Current Ratio 1.5 1.26 1.34

Working Capita/Total Assets .11 .05 .13

Debt Ratios

Total Debt to Equity .11 .09 .16

Long Term Debt to Assets .06 .05 .07

Efficiency Ratios

Total Assets/Revenue 2.4 2.6 1.4

Revenues/Working Capital 3.97 7.43 5.2

The meaning of these ratios is as follows.

Profitability ratios focus on the earnings of a firm. Return on equity is a measure of the return on shareholder's equity. Return on assets measures profitability relative to total assets. Return on assets shows what income was generated from the assets of the firm. Return on investment shows the profit or loss from investment in a firm. It is ideal from an investor's standpoint to have this value as high as possible. Gross margin shows the portion of each dollar earned as revenue that is gross profit. The operating margin measures the company's...