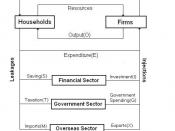

Five Sector Circular Flow of Income

The five sector circular flow of income shows the distribution of income within the economy. It has five main subsidiaries or contributors, including individuals, businesses, financial institutions, the government and international trade and financial flow. Each of these sectors contribute to either the leakages or injections (or both) of the circular flow of income.

Individuals, refers to all members of the economy, regardless of employment or financial status. They are concerned with the activities of earning an income and spending on goods and services. They are consumers, as well as the owners of productive resources. This means individuals supply factors of production such as labour and enterprise, and for this they are rewarded by businesses with wages, rent, royalties and other forms of income. This income is then spent on locally manufactured goods and services, imports, taxes and savings.

The business sector includes all business firms involved in the production of goods and services.

It does not include financial services. Businesses deal with all activities involved in buying factors of production and using them to produce goods and services. They depend on individuals for both the supply of resources needed for production and the consumption of goods and services produced. Individuals require businesses to provide goods and services and income. This interdependence is essential to the circular flow of income. Businesses form the private sector of our economy.

The financial institutions sect relates to all institutions involved in borrowing and lending money. They are the median between borrowers and lenders of money. Some financial institutions include banks, building societies, life insurance companies and Superannuation. They are needed by establishments and firms to undertake savings and investment. Financial Intermediariefs accept deposits or savings from individuals and lend to businesses for investment purposes, thereby mobilising savings.