Fixed money instrument investments takes on many forms, mutual funds, CD's, treasury bills, and bank savings accounts, to name a few. In this phase of building our portfolio, our investment team is given $10,000.00 to invest in one or more of the aforementioned investments. We choose mutual funds because investors can choose to invest in certain sectors and leave the research and management of the portfolio in the hands of the portfolio manager. We will begin with providing a general definition of a mutual fund and an example of how it is funded.

"A mutual fund is a company that invests most of its money in publicly traded securities-stocks of business corporations and bonds of various entities, business as well as government. A mutual fund is also called an investment, or unit, trust; it obtains its capital by issuing and selling its shares (common stock) to investors, typically small individual investors, who are the company's shareholders."

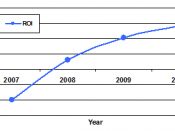

(Bauman, 2007)The Vanguard Total Stock Market Index (VTSMX) seeks to track the performance of a benchmark index that measures the investment return of the overall stock market. VTXMX employs a passive management strategy intended to track the performance of the MSCI US Broad Market index, which consists of all the U.S. common stocks traded regularly on the NYSE, AMEX, or OTC markets. It typically invests to a large extent all of assets in the 1,300 largest stocks in its target index, thus covering nearly 95% of the Index's total market capitalization (Google Finance, 2007). VTSMX, like most vanguard funds has the added benefit of having some of the industries lowest fees. VTSMX has 0.00% front load, expense ratio of 0.19%, and maximum management fees of 0.17%. The category benchmarks are 4.78%, 1.18% and 0.54% respectively. Given an initial investment of $10,000.00 with $1,126.00 profit...