What drives firms to pay dividends? Advantages and disadvantages.

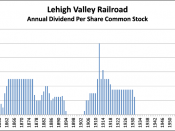

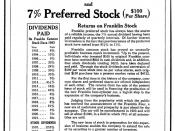

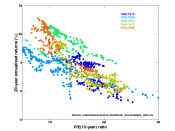

Dividends are set by the firm's board of directors and can come in the form of cash or stock dividends. Instead of retaining earnings for expansion or investment in growth opportunities, the profits of the firm are converted into dividends for the shareholders. This means that high payout ratios are often paid by mature companies with limited opportunities for more growth, while zero to low payout ratios are paid by younger firms that are expanding and investing. This ratio can be found by dividing the number of dividends by the net income. Dividends can also be classified as ordinary (paid on a regular basis), or extraordinary (paid out as a one time occurrence without commitment).

While these dividends can come in cash form, they can also be offered as stock dividends. This type of dividend, however, can lead to dilution of equity and a reduction of value per share.

A stock dividend is recorded as a transaction from retained earnings to equity capital. Repurchase of stock is yet another form: the firm repurchases its own stock, which, unlike dividends, is only taxed on the capital gains of the shareholders. This one time event also allows the company to put cash back in the hands of investors without making a long term commitment.

Dividends also help to provide confidence in the companyôs financial well being. The dividend policy can provide investors with a signal regarding the firm: if dividends are increased, for example, it can be seen as a signal that management is confident in future cash flows and believes the increased dividend can be sustained. On the other hand, if dividends are cut, it can be seen as a decrease in the firm's quality and lead to a decline in share...

;)

Good info. about the advantages and disadvantages!

1 out of 1 people found this comment useful.