Business Research Design Assessment

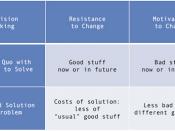

Where should decision rights be lodged in organizations? Michael C. Jensen and William H. Meckling (1992) argue that moving a decision away from the inherently best-informed party involves costs in communication and garbling but may lodge it with someone who has better incentives to make good decisions.

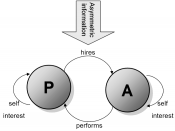

In large organization, the group of individuals who own the firm are usually separated from those who manage it. This kind of separation results in confliction of interests in these firms. In other words, problem arises when the objectives of those managing the firm differ from the owners or shareholders. The study makes use of agency theory analyses to address the problem. "There are two parties involved in agency theory: the principal or shareholder and the agent or manager" (Jo E. & Charlie W., 1995). The agents in this case include the directors and divisional managers. It is assumed in this study that the principal's first objective is wealth maximization, while the agents may have other objectives such as growth or sales rather than profit.

There has been some extensive research done on corporate governance schemes that reduce the gap between shareholders and agents interests. This article investigates four of such schemes to construct the hypotheses of the study.

Problem Statement and Corresponding Hypotheses

The problem arises in the separation of ownership from control due to the fact that such separation disables the principle to exercise full control over managerial actions. Thus, management may pursue a different objective than the principal. For example, the management may be willing to take actions that have short-term pay-offs in order to demonstrate success while the principal may be more interested in the firm's success in the long-term. Therefore, we can conclude that the principal wishes to prevent the agents from making decisions...

A deep insight on manager and owner roles and objectives in companies.

This essay seems to make some good points on why, when, where and how conflicts may occur in businesses especially between managers and company owners. It also has some vital points on how to resolve such issues and how owners and managers can both apply factors to benefit the company/firm.

1 out of 1 people found this comment useful.