Introduction

The planned tax reform which should be brought forward from 2005 to 2004 was supposed to put around 26.0 billion (amounting to 1.2% of GDP) back into German people's pockets. But after the compromise between CDU and SPD the mixed tax reform for 2004 saves only 22 billion for the people. This amount is not available for the most households because other limitations and regulations like the abolition of "Eigenheimzulage" reduce the surplus to a minimum for most of the taxpayers. The survey from Emnid illustrates the situation in the population. More than three-quarter of the population did not expect an increase of demand [Picture 1].

Germany is in a recession [Picture 2]; the economy is under pressure and can not work high efficiency because of low demand. Higher demand and a lower unemployment rate can bring Germany trough the Recessionary Trough.

The German government uses the Keynesian model of expansionary fiscal policy to reduce the income taxes and achieve a higher amount of potential outcome.

This reduction should increase the national income of the population and in consequence the consumption expenditure of the households. Picture 3 illustrates the key markets which are mainly influenced by the tax reform and set the framework for this assignment.

Question I

What can be the effects on aggregate demand and supply in the short run, on growth and potential output in the long run?

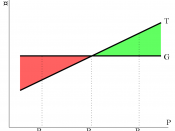

The result of the combined tax reform of the German government in 2004 is that German households have in the first moment without looking on other influences and regulations more income after tax. Picture 3 demonstrates more national income (green) as the result of lower taxes (red). This increased income influences in a short term the aggregate demand in a positive way (Picture 3: consumptions, green), under...